Archive for January, 2018

Passing Your Business to Family: Exit Planning Under the New Tax Laws

If your exit strategy is to one day pass your business down to one or more of your family members, which we call following a “Passer” exit strategy, then the new tax laws effective January 1, 2018, present a radically changed landscape for your exit planning.1 Business owners who are Passers and intend to keep the business within the family need to know what the new laws include, and how to best achieve your exit goals now that the rules have changed.

The Tax Cuts and Jobs Act (TCJA) is perhaps the most sweeping US tax law change in several decades, with a long list of changes to corporate tax rates, personal income tax rates, and other areas. However, it is how TCJA has changed estate and gift taxes that presents the biggest news for owners who may be Passers. The reason why Passers must pay special attention to estate/gift/generation-skipping taxes is that these taxes often present the greatest potential cost and obstacle to transferring the business down to the next generation.2

For Passers, TCJA presents good news—somewhat.

The biggest potential good news for Passers under TCJA is that the number of assets that can be sheltered from estate/gift/generation-skipping taxes has doubled, from about $5.5 million per eligible taxpayer to about $11 million per taxpayer starting in 2018. If married, that means an eligible couple can now shelter about $22 million in total assets from estate/gift/generation-skipping taxes. For business owners seeking to one day pass the business down to the kids (or other family members) for low to no taxes, this is huge news. As long as your interest in your business is potentially worth less than $22 million, under TCJA, you can pass the business for zero taxes. If your business interest is worth more than $22 million, you still get the first $22 million of asset transfers tax-free, and then work with your tax and legal advisors to consider additional strategies to address the taxes that may be triggered above the $22 million thresholds. (The top estate/gift/generation-skipping tax rate remains 40% under TCJA.)

“What Congress giveth, Congress taketh away too.”

It would be helpful if the story stopped right there, however, what Congress giveth, Congress can taketh away too. The tax law change that doubles the amount you can shelter from estate/gift/generation-skipping taxes expires on December 31 st , 2025. After then, unless Congress takes new action, the amount you can shelter from these taxes reverts to the pre-TCJA amounts. That presents both an opportunity and challenge for Passers. It means you have only eight years from when the law kicks in to take advantage of it before the old limits re-apply. Eight years from the time of this writing may seem like a long time, but there is a lot to take into consideration when passing a business down to the kids or other heirs:

- Are you ready to give up control?

- Are the kids ready to run the business? If not, will they be old enough and ready in time?

- How will you make sure you have sufficient assets and income to achieve your personal financial goals, once the business has passed to the next generation?

- Do you have kids who are not working in the business? If yes, how do you treat them fairly without splitting up the company?

These are just some of the questions many Passers face, and now there is a countdown clock ticking down that puts pressure on Passers to figure out the answers before the end of 2025.

Put this all together, and it means if you are a Passer, it’s time to get started on your exit planning. Or if you have started already, you’ll likely need to conduct a thorough review of your exit plans because the rules of the game have changed—at least for a while. Meet with your exit, tax, and legal advisors to discuss how to achieve your exit goals under these new tax laws.

Call 772-210-4499 or email Tim to find out more about exit planning solutions.

Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

- There are only four possible exit strategies. If your intended exit strategy is to pass your business down to a family member, we call this being a “Passer”. Call Tim to learn about the three other exit strategies, and to help discern which may apply to your situation.

- For a full discussion how these taxes work and impact business owners, order a copy of Dance in the End Zone: The Business Owner’s Exit Planning Playbook™by Patrick Ungashick.

Exit Planning Under the New Tax Laws

SPECIAL ALERT:

While the Tax Cuts and Jobs Act (TCJA) impacts every corner of the US economy and everyone it in, the new law impacts business owners perhaps more than anybody. The new law also reshapes how owners must approach their exit planning.

Exit Planning Under the New Tax Laws Webinar

Jan 23, 2018 @ 2PM – 3PM EST

Register now

Register now!

This webinar explains how, and covers:

- How the new laws change old assumptions

- Issues business owners must consider under these new rules

- Key provisions of TCJA

Check out our archive of all past NAVIX exit planning webinars:

Click here to view now

Pursuing Financial Freedom Under the New Tax Laws

For most business owners, the number one goal to achieve at exit is to reach financial freedom. (We define financial freedom as reaching a level of wealth where work is a choice, not a necessity.) However, business owners face a number of costs in their pursuit of financial freedom, the greatest of which usually is income taxes. With the US Congress and President Trump enacting into law on December 22, 2017, the Tax Cuts and Jobs Act (TCJA), business owners seeking to achieve financial freedom at exit now have a vastly changed tax landscape to work within. And while the headlines all seem to indicate that TCJA reduces income taxes across the board, the truth is more complicated…

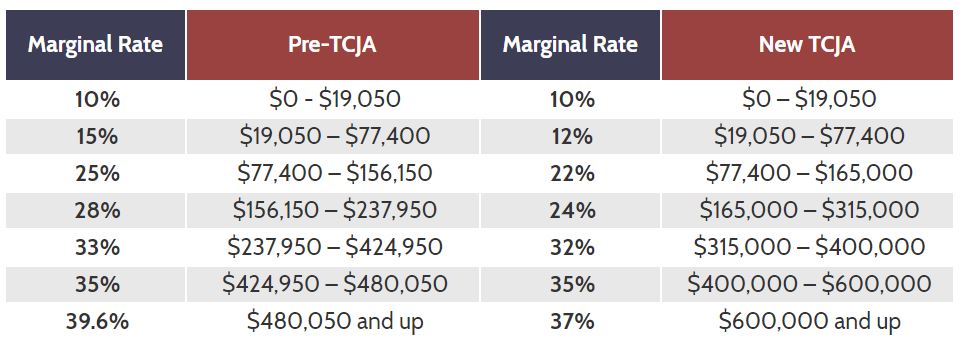

To start, US federal income tax rates have been reduced under TCJA. The top rate is reduced from 39.6% down to 37%, and most of the other rates in the seven brackets are reduced as well. Additionally, income required to cross over into the next marginal rate is now substantially higher, further reducing potential taxes. For example, the chart below compares the new rates under TCJA to the old rates for US taxpayers who are married and file jointly.

There are other potentially positive changes under the new tax laws as well. To point out a few highlights that may apply to business owners seeking financial freedom:

- C-corporation income tax rates have been permanently reduced from 35% to 21%.

- Certain “pass-through” entities, most commonly S-corporations and LLCs, may be eligible for a 20% federal income tax deduction in some situations. Because this new provision of the tax code has the potential for causing significant confusion, we will be hosting a free webinar for business owners on TCJA and how it impacts their exit planning Register today.

- Alternative Minimum Tax (AMT) has been repealed for C-corporations, and exemption amounts increased for personal income taxpayers.

If the story stopped there, it would be all good news. However, Congress giveth, and Congress taketh away too. There are some additional changes to the tax code that may negatively impact certain taxpayers, especially higher net worth and/or higher income business owners. For example, two new provisions likely to negatively impact successful business owners are:

- TCJA limits personal state and local tax deduction to a combined $10,000 for income, sales, and property taxes. This provision will hit hardest taxpayers who live in high-income tax rate states (such as California and New York), and/or taxpayers who own a larger amount of property and pay a more considerable amount of property taxes.

- For primary and secondary residences bought Dec. 15, 2017, or later, you now may deduct the interest you pay on mortgage debt up to $750,000, down from $1 million. Again, business owners with mortgages on first and second homes may face higher taxes under this provision.

TCJA contains dozens of additional provisions that, depending on your circumstances, may reduce or increase your tax bill. Frustratingly, there is one other aspect to the new tax laws that every business owner must understand—most of the personal and pass-through income tax reductions automatically expire (“sunset”) after 2025. This frustrates and complicates planning for financial freedom because owners now must make sure that their financial modeling and analysis accounts for these changes to revert to the pre-2018 rules.

Put this all together, and the most important conclusion is business owners need to sit down and recalculate their plan and path to reach financial freedom. Taxes are likely the number one cost you will pay as you monetize your company and build personal wealth. With the myriad of changes brought by TCJA, old assumptions no longer apply. At NAVIX, we call the process of planning for financial freedom calculating your Exit Magic Number™. To learn more about our approach, download the Exit Magic Number™ eBook.

Now that we have these new tax rules in place, it’s probably time to get started.

Call 772-210-4499 or email Tim to find out more about exit planning solutions.

Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

Special Alert: The New Tax Laws and How They Impact Business Owners and Exit Planning

SPECIAL ALERT:

On December 22, 2017, President Trump signed into law the Tax Cut and Jobs Act (TCJA), the biggest reform to US taxes in several decades. The tax changes impact every corner of the economy, and every American taxpayer and business. Over the next few weeks, we will summarize important information about the major provisions of the new tax laws, and how they may impact business owners and their preparations for exit. The highlight of our analysis will be an in-depth webinar about exit planning under the new tax laws, to be broadcast on Tuesday, January 23rd at 2:00 pm ET.

Click here to register for our upcoming Exit Planning Under the New Tax Laws webinar.

But first, here is a summary of the major provisions of TCJA:

Selected Changes Impacting Businesses

- C-corporation income tax rates are permanently cut from 35% to 21% starting in 2018. This represents the largest one-time reduction in corporate tax rates in US history.

- The Alternative Minimum Tax (AMT) for C-corporations is eliminated.

- “Pass through” companies (typically S-corporations and LLCs) can now deduct 20% of certain types of non-salary business income, bringing the top marginal tax rate down from 39.6% under current law to 29.6%. Specific service industries, such as health, law, and professional services, with income over $315,000 (married filing jointly) are excluded. This provision expires after 2025.

- Full and immediate expensing of short-lived capital investments for five years. Increases the Section 179 cap from $500,000 to $1 million.

- The current unlimited deduction for net interest expense for C-corporations is capped at 30% of earnings before interest and taxes. For the first four years, the cap applies to 30% of EBITDA. Thereafter, the cap is applied to EBIT.

- Eliminates net operating loss carrybacks and limits carryforwards to 80% of taxable income.

Selected Changes Impacting Individuals

- Income tax brackets and rates have been lowered. There will still be seven brackets, but their cutoff points will be lower: 10, 12, 22, 24, 32, 35, and 37%.

- An increase in the standard deduction. Single filers will get a $12,000 deduction; heads of household, $18,000; and joint filers, $24,000. The personal exemption, though, has been discontinued. These provisions sunset in 2025.

- Property taxes, sales tax, and/or state/local income taxes paid are now limited to a combined $10,000 deduction per year.

- Mortgage interest deduction lowered. This deduction, which can be applied to the acquisition of either first or second homes, is limited to a debt of $750,000. Interest on HELOC loans will not be deductible. For those who have existing loans, the current $1,000,000 cap is retained.

- Expanded use of 529 education savings plans. Taxpayers can now distribute up to $10,000 per year from 529 accounts for K-12 private schools and to help with homeschooling costs.

- Estate tax lifetime exemption amount has doubled to about $11 million per eligible taxpayer, and therefore $22 million for married couples.

These are just some of the changes included in this sweeping tax reform. For the next few weeks, we will provide additional analysis of the new tax laws, and discuss how they impact business owners and exit planning. To receive timely news and articles on exit planning, subscribe now to our weekly Exit Playbook™ Blog.

Disclaimer – This article is for educational purposes and does not constitute tax advice. Readers should consult their tax advisor to evaluate this information and determine how it may apply in their situation.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.