Pursuing Financial Freedom Under the New Tax Laws

11.01.2018

For most business owners, the number one goal to achieve at exit is to reach financial freedom. (We define financial freedom as reaching a level of wealth where work is a choice, not a necessity.) However, business owners face a number of costs in their pursuit of financial freedom, the greatest of which usually is income taxes. With the US Congress and President Trump enacting into law on December 22, 2017, the Tax Cuts and Jobs Act (TCJA), business owners seeking to achieve financial freedom at exit now have a vastly changed tax landscape to work within. And while the headlines all seem to indicate that TCJA reduces income taxes across the board, the truth is more complicated…

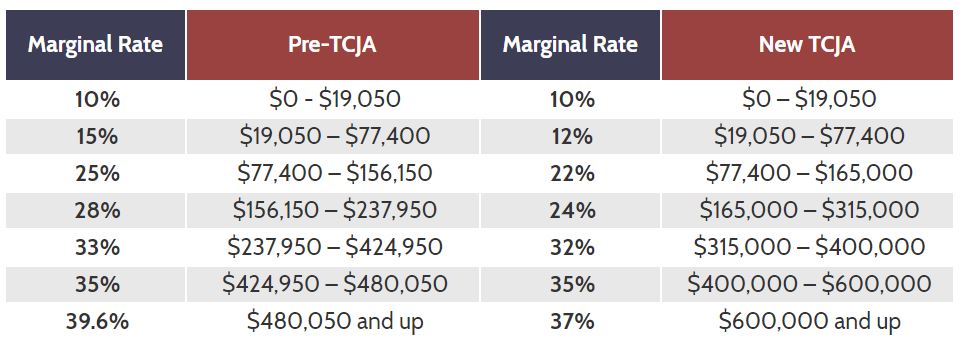

To start, US federal income tax rates have been reduced under TCJA. The top rate is reduced from 39.6% down to 37%, and most of the other rates in the seven brackets are reduced as well. Additionally, income required to cross over into the next marginal rate is now substantially higher, further reducing potential taxes. For example, the chart below compares the new rates under TCJA to the old rates for US taxpayers who are married and file jointly.

There are other potentially positive changes under the new tax laws as well. To point out a few highlights that may apply to business owners seeking financial freedom:

- C-corporation income tax rates have been permanently reduced from 35% to 21%.

- Certain “pass-through” entities, most commonly S-corporations and LLCs, may be eligible for a 20% federal income tax deduction in some situations. Because this new provision of the tax code has the potential for causing significant confusion, we will be hosting a free webinar for business owners on TCJA and how it impacts their exit planning Register today.

- Alternative Minimum Tax (AMT) has been repealed for C-corporations, and exemption amounts increased for personal income taxpayers.

If the story stopped there, it would be all good news. However, Congress giveth, and Congress taketh away too. There are some additional changes to the tax code that may negatively impact certain taxpayers, especially higher net worth and/or higher income business owners. For example, two new provisions likely to negatively impact successful business owners are:

- TCJA limits personal state and local tax deduction to a combined $10,000 for income, sales, and property taxes. This provision will hit hardest taxpayers who live in high-income tax rate states (such as California and New York), and/or taxpayers who own a larger amount of property and pay a more considerable amount of property taxes.

- For primary and secondary residences bought Dec. 15, 2017, or later, you now may deduct the interest you pay on mortgage debt up to $750,000, down from $1 million. Again, business owners with mortgages on first and second homes may face higher taxes under this provision.

TCJA contains dozens of additional provisions that, depending on your circumstances, may reduce or increase your tax bill. Frustratingly, there is one other aspect to the new tax laws that every business owner must understand—most of the personal and pass-through income tax reductions automatically expire (“sunset”) after 2025. This frustrates and complicates planning for financial freedom because owners now must make sure that their financial modeling and analysis accounts for these changes to revert to the pre-2018 rules.

Put this all together, and the most important conclusion is business owners need to sit down and recalculate their plan and path to reach financial freedom. Taxes are likely the number one cost you will pay as you monetize your company and build personal wealth. With the myriad of changes brought by TCJA, old assumptions no longer apply. At NAVIX, we call the process of planning for financial freedom calculating your Exit Magic Number™. To learn more about our approach, download the Exit Magic Number™ eBook.

Now that we have these new tax rules in place, it’s probably time to get started.

Call 772-210-4499 or email Tim to find out more about exit planning solutions.

Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.