Posts Tagged "New Tax Laws"

Your Last Five Years: How Much Do I Need to Net from My Exit to Achieve Financial Freedom?

In Part 1 of this series on Your Last Five Years, we examined why five years is the tipping point when owners must start formally planning their exit. Click here to review that article now.

In Part 2 of this series, we looked at the five questions owners need to answer once they reach the critical five-year tipping point, and explored the first question, which is “What is My Likely Exit Strategy?” Click here to review that article now.

You, as a business owner, must answer five critical questions once you reach five years before your desired exit. These five questions define your exit goals and help shape the plan for how you will achieve those goals. As stated in previous articles in this series, there’s no way to sugar-coat this—answering these five questions must happen as you enter Your Last Five Years. Without clear answers, you will not know the steps needed for your exit planning, and you potentially run out of time to maximize your exit success.

The five questions are:

- What is My Likely Exit Strategy?

- How Much Do I Need to Net From My Exit?

- What Do I Want My Legacy to Be?

- What Do I Want To Do in Life After Exit?

- How Exitable is My Company?

Question 2: “How Much Do I Need to Net From My Exit?”

The top goal most business owners desire to achieve at exit is to reach financial freedom. While everybody’s economic situation is different, practically all owners share the same definition of financial freedom—having enough personal wealth so that work becomes a choice and not a necessity. (Money does not buy happiness, but in our experiences, most owners who reach financial freedom are typically smiling, so there is something important happening here.) Therefore, to answer how much you need to net from your exit, we need to know how much you need to reach financial freedom.

Unfortunately, we have observed that most owners do not know how to identify the right amount they need at exit to reach their desired financial freedom. It’s not the same thing as knowing what your business may be worth or knowing the balance of your current investment and/or real estate portfolio. Those numbers are what you have. We need to know how much you still need. We have also observed that owners who believe they know how much they need typically underestimate the amount. Why? Most financial analysis is done based on the owner’s personal spending to support the desired lifestyle. But business owners have personal lifestyles heavily subsidized by the business checkbook. Some to all of the following may be paid for you by your company: cell phones and service plans, laptop computers, cars and associated monthly expenses, meals, business travel that doubles as personal trips, club dues, and insurance and benefits. These business expenses will become personal expenses upon your exit. Too often these expenses are overlooked or underestimated.

To help owners accurately determine how much they need to net at exit, we devised the Exit Magic Number™ calculation. This analysis does not look at how much you have, but rather how much you need to reach financial freedom. It’s the most important number a business owner needs to know. Click here to access our free eBook on the Exit Magic Number™ and other related resources.

Last, why is knowing this number critical when you reach Your Last Five Years? Because with only five years left before you desire to exit, it’s imperative to know now if you are on track to reach financial freedom, or not. If you are not on track, meaning if you are coming up short at this time, better to know that now when you have time to adjust your plan or goals. If you are on track, or even better if you have a surplus, knowing that now is just as important. A surplus may permit you to exit sooner, or consider some aggressive tax planning tactics, or perhaps more share ownership with your employees. If you don’t know your Exit Magic Number™ until shortly before your exit—or even worse until after you have already exited—it becomes too late to act.

In the next article in this series, we will examine the third question you must answer when entering Your Last Five Years: “What Do I Want My Legacy to Be?”

Call 772-210-4499 or email Tim to find out more about exit planning solutions. Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

Call 772-210-4499 or email Tim to find out more about exit planning solutions. Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

12 Timely Questions the New Tax Laws Raise for Every Business Owner in America

The Tax Cuts and Jobs Act (TCJA) is perhaps the most sweeping US tax law change in several decades, with a long list of changes to corporate tax rates, personal income tax rates, and other areas. The new laws change much of the tax landscape for businesses and their owners—now and at exit.

Therefore, owners contemplating exit should sit down with their tax, legal, financial, and exit advisors to discuss the new laws and evaluate what steps they must take in this new world.

To aid you, listed below are 12 questions that owners should put to their advisors. We recommend owners print this list and set up a meeting with their advisory team to discuss and review:

12 Questions that Owners Should Put to Their Advisors

Under the new laws, which legal form(g., C-corporation, S-corporation, LLC, partnership, etc.) is most advantageous for our current needs? How about at exit?

Which of themany new and revised tax regulations under TCJAmay NEGATIVELY impact our business? What actions should we consider as a result?

Which of the many new and revised tax regulations under TCJA may POSITIVELY impact our business? What actions should we consider as a result?

Does TCJA contain any provisions that require us to re-evaluate our current: ownership structure, owner compensation practices, capital structure, and equipment purchasing and/or leasing plans?

Given that our likely exit strategy is to one day (Pick one):

□ Sell to an outside buyer

□ Sell to an inside buyer

□ Pass the business down to family

□ Shut the business down

Under the new tax laws, we should:

_______________________________________

(Answer with the actionable ideas discussed with your advisor)

Given that our desired exit timeframe is to exit (Pick one):

□ Within next 12 months

□ Between one and three years from now

□ Between three and five years from now

□ Between five and ten years from now

□ Longer than ten years from now

Under the new tax laws, we should: _________________________________________

(Answer with the actionable ideas discussed with your advisor)

What will my personal income tax picture look like under the new laws? (We recommend modeling them to compare before and after TCJA.)

If the new laws present a significant change (positive or negative) to my personal income tax burden, consequently, what steps should I consider to best achieve my immediate and future financial goals?

Which of the many new and revised tax regulations under TCJA may negatively impact my personal financial planning and picture? What actions should we consider as a result?

Which of the many new and revised tax regulations under TCJA may positively impact my personal financial planning and picture? What actions should we consider as a result?

What changes, if any, should I consider to my personal estate planning as a result of the new tax laws?

What else should I consider doing within my business and my personal financial affairs as a result of the new tax laws that we have not yet discussed?

We encourage you to review these questions with your trusted advisors as soon as possible.

If you would like to review your answers with a NAVIX Consultant, Call 772-210-4499 or email Tim for a complimentary 45-minute consultation.

12 questions that Owners Should Put to Their Advisors

Exit Planning Under the New Tax Laws: Should You Be a C-Corporation?

While there are many material differences between C-corporations and other legal forms, for this purpose the most important tax difference is that C-corporations pay taxes on income, whereas the other commonly used legal forms are pass-through entities, which mean taxable income (or losses) “pass-through” to the owners’ personal income tax returns. This difference is relevant because, despite the much-hyped tax cut, owners of C-corporations still face under the new tax laws the risk of double-taxation when they sell the company. If double-taxation sounds bad, that’s because it usually is.

Here’s what double-taxation means, and why it occurs. When corporations are sold, the buyer has a choice to make. Does the buyer want to purchase the corporation’s stock from whomever or whatever owns it, or does the buyer want to purchase the company’s assets from the corporation itself? The two options are thus called stock sales (a.k.a. entity sales) and asset sales. Buyers overwhelmingly prefer asset sales, for two main reasons. First, stock sales increase potential risk to buyers, because if they buy the stock, they may inherit future liabilities attached to that stock, whether known or unknown at the time of sale. The second reason buyers overwhelmingly prefer asset sales is because asset sales typically are more attractive to the buyer financially. In an asset sale, the buyer gets to depreciate on its tax return some assets faster than it commonly would be able with a stock sale. For these two reasons, buyers prefer asset sales.

Are you familiar with the adage that says in any negotiation between two parties where one has all of the money, and the other does not, the one with the money wins? Well, the adage applies here. The buyers have the money. So, more often than not, buyers get their way and require asset sales. (There is even a provision of the tax code called Section 338(h)(10) that lets buyers treat the sale as if it were an asset sale for tax purposes, even though structurally the transaction was a stock sale. This is called a deemed asset sale.)

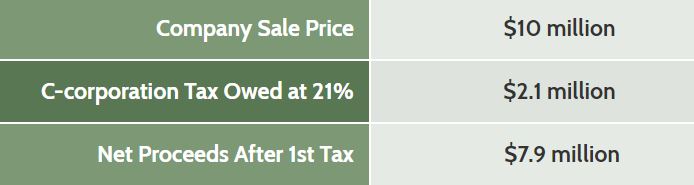

So that means if you intend to sell your company one day, the future sale most likely will be an asset sale. That’s when double-taxation kicks in. First, the buyer purchases from the corporation its assets. At that point, a C-corporation now has to pay any taxes owed from the sale of its assets. Let’s create a simple example. Assume a $10 million asset purchase price, and the company pays exactly 21% in taxes, which is $2.1 million.

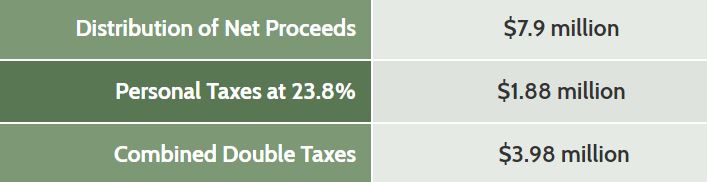

Once the dust has settled, the seller is now left with an empty C-corporation, other than the $7.9 million in after-tax cash from the sale proceeds sitting in the company’s bank account. At that point, the seller wants to take money home thank-you-very-much, and so distributes the money out to the owner(s). That triggers the second tax. Let’s assume that second tax is all long-term capital gains taxes at 20%, plus the 3.8% Net Investment Income Tax that usually applies. So now that’s another $1.88 million in personal taxes ($7.9 million X .238) as shown below. Put the two levels of tax together, and the total taxes paid at sale are about $3.98 million on the original $10 million sale.

The double-taxation creates almost a 40% total tax burden—and this example does not include any state or local taxes, which would only add to the total. So, even though the C-corporation tax rate is reduced, if you intend to sell your company one day to an outside buyer, it remains highly disadvantageous to sell your business while a C-corporation in most situations.

One last important point to remember: If you have a company that is a C-corporation that you expect to sell, and to avoid double-taxation you usually would convert that C-corporation into an S-corporation. However, you must outwait that conversion by five years to eliminate all risk of double-taxation at sale. This arcane tax provision is called the Built In Gains tax—yes, the BIG tax. We can’t make this stuff up.

Operating as a C-corporation may only be advantageous if you are confident that you will not sell the company for any reason within the next five years, or if you never intend to sell your business but instead you give it to family members in the future. All of this reinforces that business owners need to think through their exit and plan ahead on tax questions, many years prior to exit.

This information is for educational purposes only. Please consult your tax, legal, and other advisors to evaluate how this material may apply to you and your businesses. NAVIX does not provide tax or legal advice nor services.

Call 772-210-4499 or email Tim to find out more about exit planning solutions.

Call 772-210-4499 or email Tim to find out more about exit planning solutions.

Ask about our complimentary proprietary tools and checklists. All inquiries are confidential.

Exit Planning Under the New Tax Laws

SPECIAL ALERT:

While the Tax Cuts and Jobs Act (TCJA) impacts every corner of the US economy and everyone it in, the new law impacts business owners perhaps more than anybody. The new law also reshapes how owners must approach their exit planning.

Exit Planning Under the New Tax Laws Webinar

Jan 23, 2018 @ 2PM – 3PM EST

Register now

Register now!

This webinar explains how, and covers:

- How the new laws change old assumptions

- Issues business owners must consider under these new rules

- Key provisions of TCJA

Check out our archive of all past NAVIX exit planning webinars:

Click here to view now

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.