Archive for April, 2020

PPP Funds Replenished – What You Need to Know

By: Patrick Ungashick

To help our clients and other business owners and leaders respond to the unprecedented leadership disruptions caused by the coronavirus (COVID-19) outbreak, the team at NAVIX offers the following crisis management information series.

Responding to Coronavirus: PPP Funds Replenished – What You Need to Know

April 24, 2020 @ 12:00 PM

US federal lawmakers today passed legislation that replenishes the Payroll Protection Program (PPP) forgivable loan program, adding another $310 billion to the forgivable loan program created by the CARES Act in response to the coronavirus crisis. The first found of PPP funding, some $349 billion, was exhausted in 14 days as about 1.6 million US businesses rushed to secure a PPP loan.

Today’s legislation also restocks the SBA Economic Income Disaster Loan (EIDL) programs, adding $10 billion to the emergency grant program and $50 billion for disaster recovery loans. Both of those lending programs were fully exhausted, as US companies seek relief to help deal with the unprecedented challenges presented by the COVID-19 crisis.

If your company did not secure a PPP loan during the first round of funding, consider contacting your SBA-approved bank or other lending organization and completing an application as quickly as possible. Demand for the second round of funding is expected to be even greater than the first round.

If you did successfully complete a PPP loan and either have received your funds or are waiting for the funds to be released, be sure to study carefully the guidelines on the proper use of the funds and how to maximize loan forgiveness.

The following free resources can assist you with PPP and other relief programs available through the CARES Act:

- PPP 40-Frequently Asked Questions – free article

- How to Maximize Your PPP Funds – free article

- CARES Act 11-Point Executive Summary – free PDF download

The NAVIX team has helped hundreds of business owners prepare for exit. We have also helped countless owners and leaders deal with recessions, liquidity crises, and economic upheaval. Our experience and perspective enable us to guide our clients through difficult times, such as these.

Contact Tim 772-221-4499, to discuss strategies for your business.

Communicating in Times of Crisis

Even when money is tight and the future is uncertain, remember to keep making deposits to your emotional bank account.

We are all living in highly stressful times; I hope this message finds you well.

Now that so many of us are working remotely, we are finding communication much more challenging. Even with video conferencing tools, it is still difficult to observe and process all of the nonverbal cues that we used to depend on for communication with coworkers, customers, and vendors.

Some of you that are working from home are fortunate to have your family with you. But by now you know that the additional job titles of teacher, cook, entertainer, etc., come with their stress-inducing challenges.

What to do?

First:

Breathe. Nice long relaxing breaths…

What we know about DISC in our own personality can help us, and those we care about, through the new abnormal.

When stress is present, people seek to reduce it, often by dumping it on the person “responsible” for the tension, which is unproductive. Each personality style has its own characteristic manner of “dumping” stress on another.

We all have stress-inducing situations that come and go in our lives. Lately, for most of us, the stress has been sticking around a lot longer. In crisis situations stress is amplified. Behavioral expressions can change, and behaviors may intensify. We need to be ever more vigilant in our interactions with those we care about and those who are dependent on us in our work and at home. This is not easy. Even people with highly developed emotional intelligence (EIQ) are struggling.

Emotional intelligence refers to the capacity to be aware of, control and express our emotions as well as understanding the emotions of others. Empathy is an important characteristic of high EIQ but can be very difficult to display when we are stressed and outside of our comfort zone. Identifying and addressing the characteristic fears of our personality type will help to avoid some of the rough spots. Those rough spots can drain your emotional bank account and reduce your EIQ.

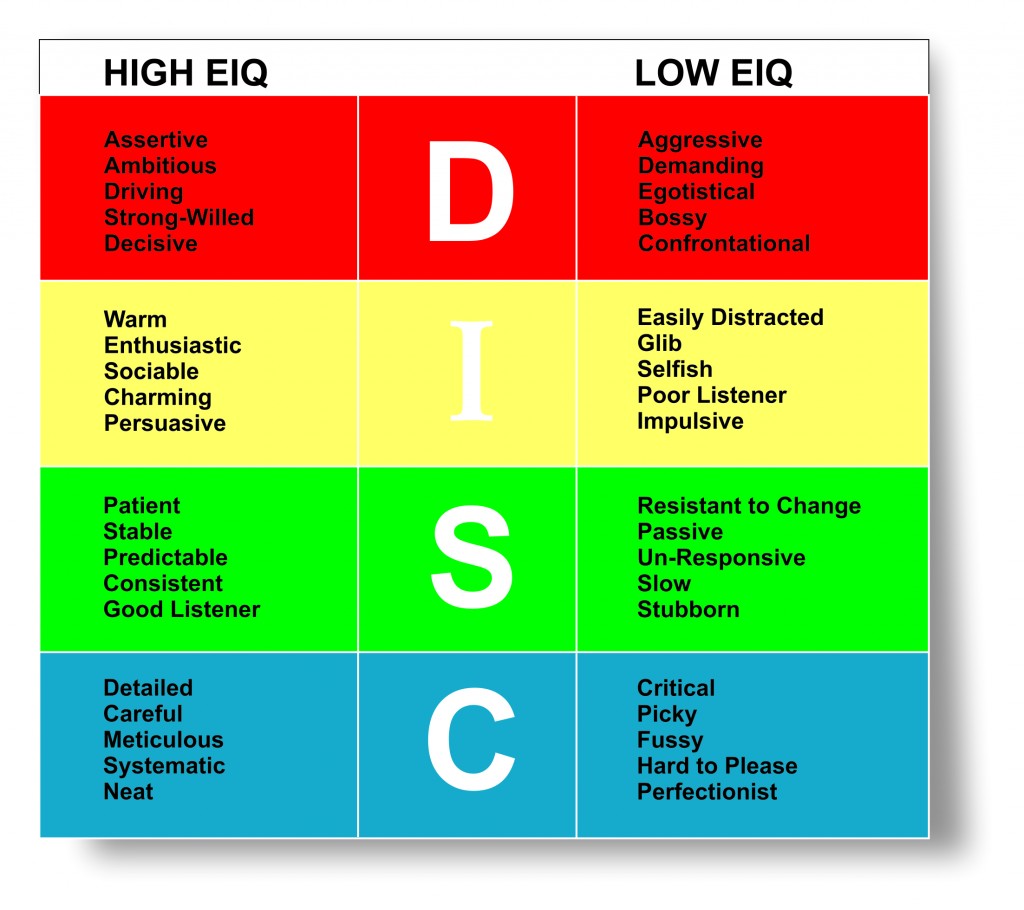

The chart below shows how a reduced EIQ can negatively impact personality traits:

DISC + EMOTIONAL INTELLIGENCE

If you found yourself migrating toward the right side of the chart recently, you are not alone. Without being conscious of the change:

- A decisive and ambitious person can become more aggressive and confrontational when things are out of control.

- A normally sociable and charming individual can become glib and distracted without enough opportunity for social interactions.

- A patient, stable person can become stubborn or even un-responsive when there is no system or the normal pace of their life is disrupted.

- A careful, neat person can become very critical and fussy when new rules or restrictions are unclear or not universally adhered to.

The good news is that you can adapt back to more positive traits. Identify the cause of the stress, based on your personality type, and address it.

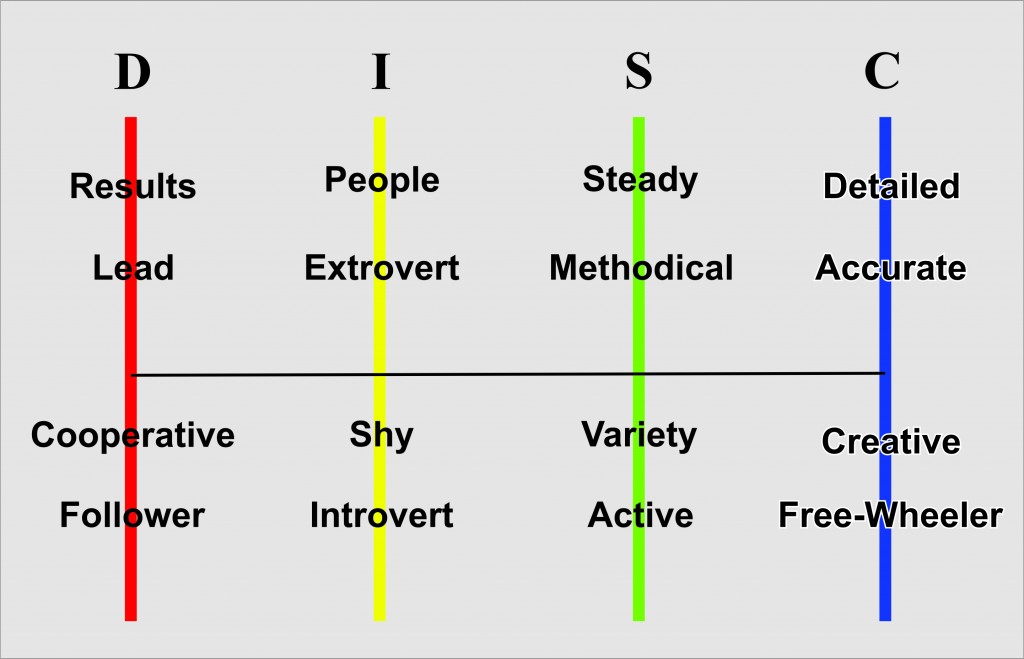

Take some time to review your Team Strength DISC profile. If you do not have a profile, then take a look at the graphic below with some broad descriptors of each of the DISC personality types. Find the broad descriptor that matches your personality best, keeping in mind that there may be two different areas that apply, and use that as your guide.

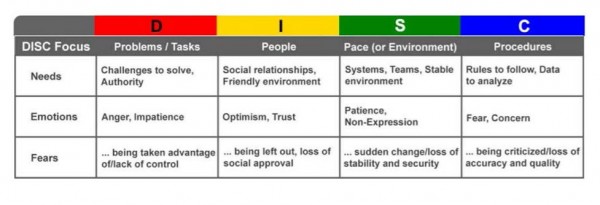

Your Team Strength DISC profile will describe in detail your personality type and highlight some of the drivers that you react to, what you need and also some of the fears that can affect you. The chart below summarizes three key areas in each of the four profile styles.

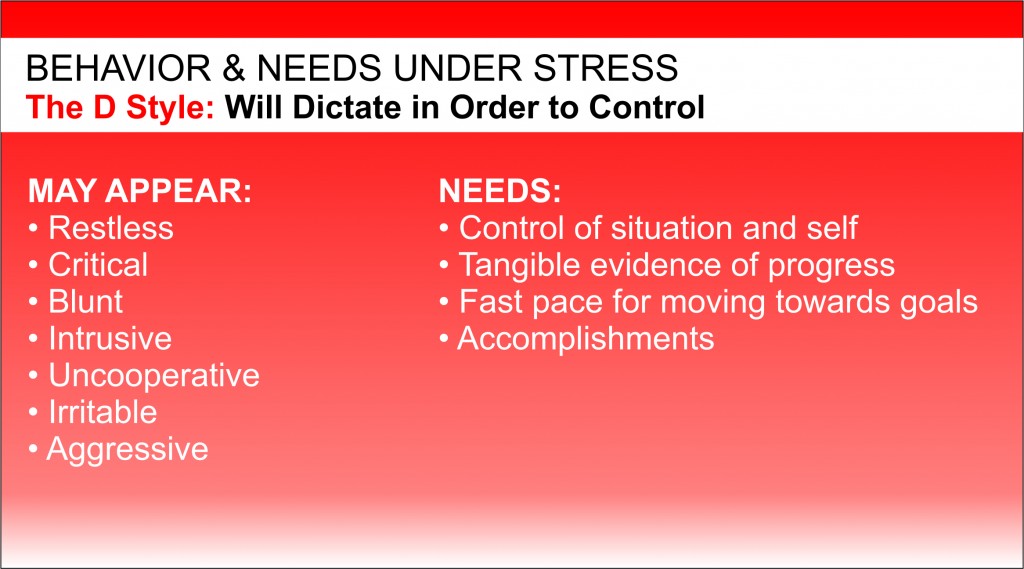

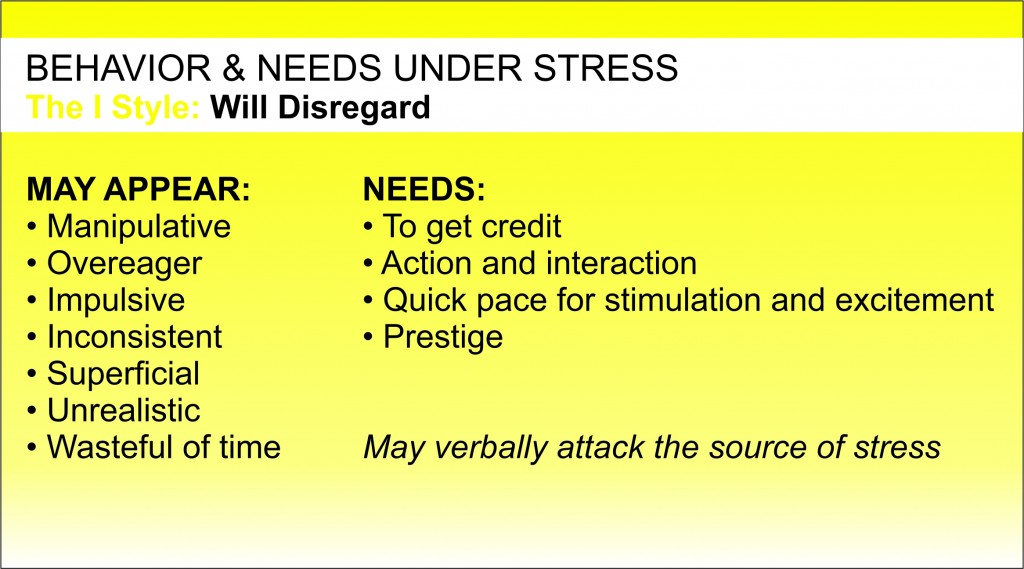

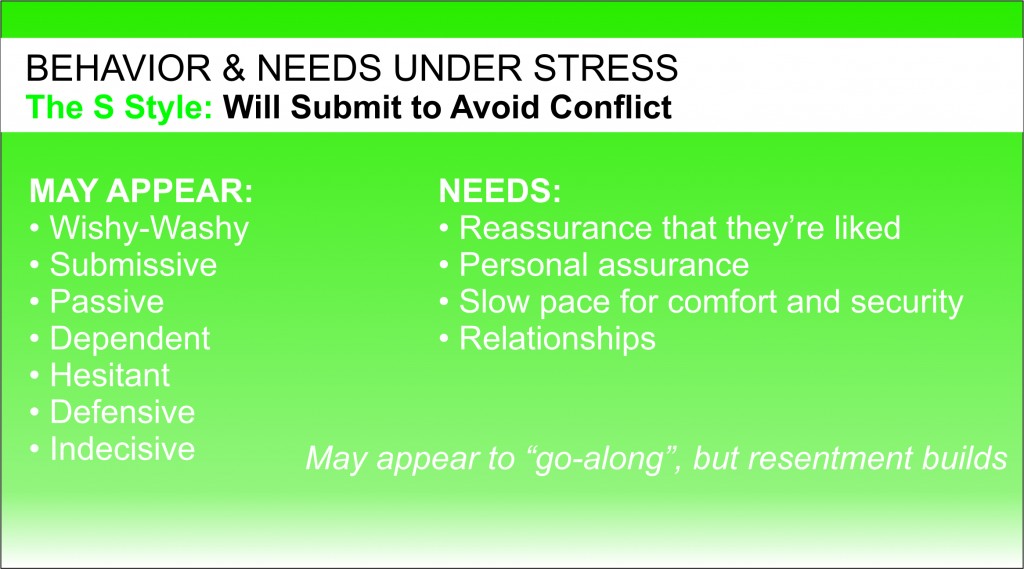

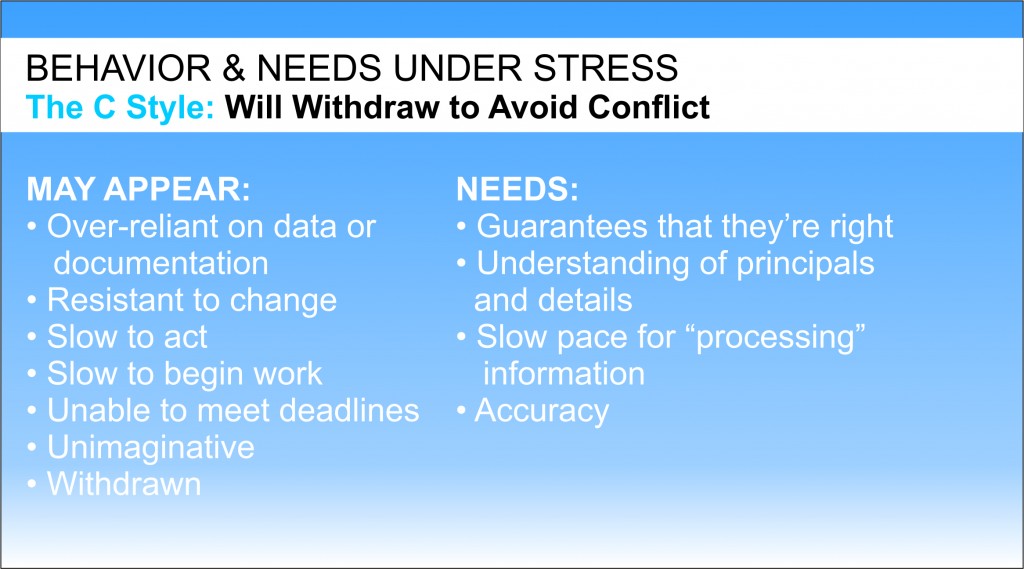

The following charts summarize the behaviors and needs of each style.

When we identify and control what is likely to stress us we can better react with thoughtfulness. (That is a good time to take a nice, deep breath.) It is OK to understand and accept that we are under stress and not in a comfortable place. That will start to refill our emotional bank account when we need it most. Here are comparisons for each style:

D Style

Emotional/Reactive: “If you can’t stand the heat, get out of the kitchen.”

Thoughtful: “I understand this is stressful. Let’s focus on what we CAN control.”

I Style

Emotional/Reactive: “Hey, let’s move on to something more positive!”

Thoughtful: “It’s difficult not seeing my friends. Can we find a time to get on a Zoom-social call?”

S Style

Emotional/Reactive: “Okay, if that’s the way you must have it, we’ll try it.”

Thoughtful: “I know things are uncertain right now. I just need to know that we are all in this together and we are going to get through it together.”

C Style

Emotional/Reactive: “I can’t help you any further. Do what you want.”

Thoughtful: “I know this is stressful. I just need to unplug for a day.”

When we can get our own emotions controlled by understanding and managing the things that we can affect, then we will be in a better position to help others. By communicating more effectively and reducing our reactive behavior, we will be in a better position to be more accommodating to those around us, on phone calls or in a video chat.

We can then remember to treat others the way they want to be treated. Don’t try to “fix” people. We can remember that they have different needs and fears and we can adapt ourselves to their pace or priority as best we can. It’s a time that we all need to listen more and pay attention to what other behavioral expressions we are broadcasting and being more accepting of the reactions of others.

So, in these troubling times, we do have the ability to make deposits to our own emotional bank account. Even better, when we pay attention and care for others, we can also make emotional deposits to the accounts of those people who are important to us.

Stay safe, stay well.

Tim

Send your questions about how to use your profile to identify and control what is likely to stress you sot that you can better react. Email

Call 772-210-4499 to set up a time to talk about tools and strategies that will lead to better results.

Please share this with a friend/colleague

More Tools:

The first step to building stronger communication is awareness. By identifying how we are similar and different, we can make cognitive choices when interacting to create stronger, more engaged relationships.

Deeper Look at Team Strength DISC Styles

PPP Confusion and Clarifications – Top 40 FAQs

By: Patrick Ungashick

To help our clients and other business owners and leaders respond to the unprecedented leadership disruptions caused by the coronavirus (COVID-19) outbreak, the team at NAVIX offers the following crisis management information series.

Responding to Coronavirus: PPP Confusion and Clarifications – Top 40 FAQs

1.What is the Payroll Protection Program (PPP)?

The PPP is a brand-new loan program created by the CARES Act in response to the COVID-19 crisis.

(Note: Click here to download our 11-point CARES Act Executive Summary.)

2.How much money is available for loans under the PPP? (Or, when does the PPP program run out?)

The CARES Act funded the PPP with $349 billion. The window to apply for the PPP closes either when the $349 billion runs out (on a first-come-first-served basis) or on June 30, 2020—whichever happens first.

(Note: At the time of this writing, some Congressional leaders are advocating additional dollars toward the PPP, but that proposal has not been enacted into law.)

3.What interest rate applies to PPP loans?

The interest rate is 1.0%.

(Note: This figure changed several times as the PPP was being rolled out, but it has settled on 1.0%.)

4.What is the maturity date for PPP loans?

The maturity date is two years, beginning when a PPP loan is made.

(Note: This figure changed several times as the PPP was being rolled out, but it has settled on two years.)

5.Does the business owner need to guarantee the PPP loan personally?

No personal guarantee is required.

6.Does the business owner need to provide collateral for a PPP loan?

No. The Small Business Administration (SBA) has waived the traditional collateral requirement for PPP loans.

7.Does an applicant need to have tried and been unsuccessful in obtaining credit elsewhere?

No. The SBA has waived the traditional requirement that an applicant has been unsuccessful in obtaining credit elsewhere.

8.What businesses are eligible to obtain PPP loans?

Generally, businesses that employ no more than 500 employees. This includes sole proprietorships, self-employed individuals, and most non-profit organizations.

However, some businesses can be eligible even if they have more than 500 employees, as long as they satisfy the existing statutory and regulatory definition of a “small business concern” under section 3 of the Small Business Act, 15 U.S.C. 632. A business can qualify if it meets the SBA employee-based or revenue-based size standard corresponding to its primary industry. Go to www.sba.gov/size for the industry size standards.

Additionally, a business can qualify for the Paycheck Protection Program as a “small business concern” if it met both tests in SBA’s “alternative size standard” as of March 27, 2020: (1) maximum tangible net worth of the business is not more than $15 million; and (2) the average net income after Federal income taxes (excluding any carry-over losses) of the business for the two full fiscal years before the date of the application is not more than $5 million.

If in doubt, contact your SBA-approved lender.

9.Can independent contractors apply for PPP loans?

Yes. While the PPP regulations clearly state that businesses cannot include independent contractors in their payroll calculations, it also states that independent contractors can apply separately for their own PPP loans starting on April 10, 2020.

10.How do you calculate the number of employees to determine the employee-based size limits?

Borrowers may use their average employment per pay period over the 12 months prior to the loan application date, or during calendar year 2019, to determine their number of employees.

(Note: Some lenders seem to be emphasizing using calendar year 2019 data.)

11.Can companies that have private equity or venture capital ownership/investments obtain loans under the PPP?

Potentially. The answer will depend on the type of investment and the degree of control held by the PE or VC organization. Contact your SBA-approved lender.

12.How do the $10 million cap and affiliation rules work for franchises?

If a franchise brand is listed on the SBA Franchise Directory, each of its franchisees that meets the applicable size standard can apply for a PPP loan. (The franchisor does not apply on behalf of its franchisees.) The $10 million cap on PPP loans is a limit per franchisee entity, and each franchisee is limited to one PPP loan. Franchise brands that have been denied listing on the Directory because of affiliation between franchisor and franchisee may request listing to receive PPP loans. SBA will not apply affiliation rules to a franchise brand requesting listing on the Directory to participate in the PPP, but SBA will confirm that the brand is otherwise eligible for listing on the Directory.

13.How do the $10 million cap and affiliation rules work for hotels and restaurants (and any business assigned a North American Industry Classification System (NAICS) code beginning with 72)?

Under the CARES Act, any single business entity that is assigned a NAICS code beginning with 72 (including hotels and restaurants) and that employs not more than 500 employees per physical location is eligible to receive a PPP loan.

In addition, SBA’s affiliation rules (13 CFR 121.103 and 13 CFR 121.301) do not apply to any business entity that is assigned a NAICS code beginning with 72 and that employs not more than a total of 500 employees. As a result, if each hotel or restaurant location owned by a parent business is a separate legal business entity, each hotel or restaurant location that employs not more than 500 employees is permitted to apply for a separate PPP loan provided it uses its unique EIN.

The $10 million maximum loan amount limitation applies to each eligible business entity because individual business entities cannot apply for more than one loan.

14.How much can an eligible borrower apply for under the PPP?

Applicants can generally borrow the lesser of $10 million, or 2.5 times the average monthly “payroll costs,” as explained below.

If there is an outstanding amount of an Economic Injury Disaster Loan (EIDL) made between January 31, 2020, and April 3, 2020, that amount can be added to the PPP loan amount request, less the amount of any loan advance received.

15.What time period should borrowers use to determine their payroll costs to calculate their maximum loan amounts?

Most borrowers will use the calendar year 2019 aggregate payroll data.

(Note: There has been inconsistent information released by the Treasury Department and SBA on this question, with many sources stating that payroll data for the immediate 12-months prior to submitting the loan application may be used instead of calendar year 2019 data. However, the SBA and lenders seem to be emphasizing using calendar year 2019 data.)

16.What if the business has seasonal workers, or is a newly established business?

For seasonal businesses, the applicant may use average monthly payroll for the period between February 15, 2019, or March 1, 2019, and June 30, 2019. An applicant that was not in business from February 15, 2019 to June 30, 2019 may use the average monthly payroll costs for the period January 1, 2020 through February 29, 2020.

17.What are “Payroll Costs?”

“Payroll costs” generally mean the following compensation elements for employees (not any independent contractors) whose principal place of residence is in the US:

- Salary, wage, commission, or similar compensation for any employee whose principal place of residence is in the U.S. (capped at $100,000 on an annualized basis for each employee)

- Cash tips or equivalents

- Payment for vacation, parental, family, medical, or sick leave

- Allowance for dismissal or separation

- Payment required for the provision of group healthcare benefits, including insurance premiums

- Payment of any retirement benefit

- Payment of state and local taxes assessed in connection with the foregoing

18.Are part-time or seasonal employees included in the payroll costs?

Yes. All employees paid during the period of time are included in payroll costs.

19.Are benefits such as healthcare, 401k, and payment of state and local taxes included in the $100,000 per employee cap?

No. The exclusion of compensation in excess of $100,000 annually applies only to cash compensation, not to non-cash benefits, including:

- Employer contributions to defined-benefit or defined-contribution retirement plans

- Payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums

- Payment of state and local taxes assessed on the compensation of employees

20.Are federal taxes included in the payroll costs used to calculate the maximum loan amount?

No. Payroll costs are calculated on a gross basis without regard to federal taxes imposed or withheld, including FICA and Medicare. Payroll costs are not reduced by taxes imposed on an employee and are not increased by the employer’s share of payroll taxes.

21.Do PPP loans cover paid sick leave?

Yes. “Payroll costs” includes costs for employee vacation, parental, family, medical, and sick leave. However, the CARES Act excludes qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act (Public Law 116–127).

22.If the borrower is an S-corporation, are S-corporation distributions included in the payroll costs?

Likely no.

“Specific guidance is not available related to shareholder distributions, but since these distributions are not considered wages to the shareholder, it is presumed that shareholder distributions are not to be included in payroll costs.”

Source: AICPA’s PPP Resources

23.If the borrower is a partnership or LLC, how should partner/member compensation be treated?

For partners in a partnership, the self-employment income of general active partners may be reported as a payroll cost, up to $100,000 annualized, on a PPP loan application filed by or on behalf of the partnership.

24.What if the business uses a Professional Employer Organization (PEO) and therefore, may not be able to document its own payroll information?

There should be proper documents that the borrower can obtain from its payroll provider for the PPP loan application process.

25.What are permissible uses for PPP funds?

Borrowers may use PPP loan funds to pay payroll costs (as previously defined), health care benefits, mortgage interest payments, rent, utility, interest payments on debt incurred prior to February 15, 2020, and/or refinancing an SBA EIDL loan made between January 31, 2020 and April 3, 2020.

26.How much of the PPP loan amount may be forgiven?

The entire PPP loan potentially may be forgiven, plus any accrued interest.

27.Is the loan forgiveness taxable?

No. Forgiveness of any portion of the PPP loan does not constitute taxable income for the borrower.

28.How is the amount of loan forgiveness calculated?

The debt eligible for forgiveness is equal to the eligible expenses paid by the borrowing company during an eight week-period beginning on the date the lender makes the first disbursement of the PPP funds to the borrower. The eligible expenses include:

- Payroll costs (as defined earlier)

- Interest on mortgage obligations incurred before February 15, 2020*

- Rent under a lease existing before February 15, 2020*

- Utilities for which service began prior to February 15, 2020*

- Refinancing an SBA EIDL loan made between January 31, 2020, and April 3, 2020 (less any advance on the EIDL loan up to $10,000)*

*No more than 25% of the forgiven amount may be attributable to non-payroll costs.

Click here to download our guide on How to Maximize the PPP Funds and loan forgiveness.

29.How is loan forgiveness reduced if the borrower lowers salaries or wages, or loses employees, during the eight-week period?

The amount of loan forgiveness is generally reduced by two factors:

- Any reduction in the ratio of (1) the average number of monthly full-time equivalent (FTE) employees during the eight-week period versus (2) those employed during one of two reference periods selected by the borrower: either February 15 to June 30, 2019 OR January 1 to February 29, 2020

- The amount of any reduction in total salary or wages of any employee during an eight-week period in excess of 25% of the total wages and salary of the employee during the most recent full quarter during which the employee was employed—taking into account only employees whose annualized salary was less than $100,000.

(Note: The SBA may provide further guidance to address any changes in non-wage benefits during the eight-week period or any changes outside of the eight-week period.)

30.Can any loan forgiveness be restored if the borrower has already cut employee salaries and/or wages, and/or reduced headcounts?

Yes.

The reduction in loan forgiveness for a reduction in salaries or wages can be avoided if the borrower restores by June 30, 2020 the same wages the employee(s) was earning as of February 15, 2020 as compared to wages paid between February 15, 2020 and April 26, 2020.

The reduction in loan forgiveness for a reduction in headcount can be avoided if the reduction in FTEs that occurred during the period between February 15, 2020 and April 26, 2020 is restored by June 30, 2020.

(Note: We expect further guidance on this issue from the SBA.)

31.What if an employee voluntarily terminates or is terminated for poor job performance? Is the loan forgiveness still reduced in those situations?

Likely yes. At this time, the CARES Act and the PPP guidance issued by the Treasury Department and SBA do not make any distinctions for why an employee may have terminated employment, so that loan forgiveness is only tied to employee count comparisons and whether or not specific employees had their pay substantially reduced. Specific guidance on this question may be forthcoming.

32.When do borrowers need to start repaying a PPP loan?

For any amount of PPP loan that is not forgiven, borrowers may defer making principal or interest payments for six months. But interest does accrue during this deferral period.

33.Are there any prepayment penalties for PPP loans?

No, there are no prepayment penalties on PPP loans.

34.Are there any fees for PPP loans?

No, PPP loans do not require any fees to be paid by the borrower.

35.How many PPP loans can a company obtain?

The program is limited to one loan per borrower, as identified by its Tax Identification Number (TIN) such as the Employer Identification Number (EIN) or the Social Security Number (SSN).

36.How do you get a PPP loan?

Contact a bank or other lending institution that is approved to work with the SBA. Due to the very high demand for PPP loans, it is best to start with your existing banking relationship.

37.When can eligible applicants apply?

Applicants can apply from April 3, 2020, to June 30, 2020.

38.What do applicants need to submit?

Generally, applicants must initially submit a completed SBA Form 2483 (Paycheck Protection Program Application Form) and payroll and other documentation to a PPP lender. The lender may require additional documentation as it deems necessary.

39.Should a business apply for PPP loans through multiple banks?

While there is no restriction against filing multiple PPP applications through different lenders, at the time of this writing, many lenders are only taking applications from existing customers due to high volume. Plus, it is possible that multiple applications from the same applicant could cause confusion, slowing the application, or even triggering potential fraud alerts. Therefore, it seems advisable to work with only one lender, if possible.

40.How long will it take until the borrower gets its funds once a PPP loan has been submitted?

The PPP regulations stipulate that lenders should issue PPP funds within 10 calendar days from the date of loan approval. However, given the massive volume of PPP loans, it is difficult to generalize on loan review and approval times. Contact your SBA-approved lender to inquire about your PPP application status.

Once you have filed your PPP loan application, read this article for 11-steps to maximize the loan forgiveness and impact on your company.

The NAVIX team has helped hundreds of business owners prepare for exit. We have also helped countless owners and leaders deal with recessions, liquidity crises, and economic upheaval. Our experience and perspective enable us to guide our clients through difficult times, such as these.

How to Maximize Your PPP Funds

By: Patrick Ungashick

To help our clients and other business owners and leaders respond to the unprecedented leadership disruptions caused by the coronavirus (COVID-19) outbreak, the team at NAVIX offers the following crisis management information series.

Responding to Coronavirus: How to Maximize Your PPP Funds

Despite widespread stories of a chaotic rollout of the CARES Act Payroll Protection Program (PPP), some of the first companies to apply have received their funds. With millions of eligible companies expected to apply for this forgivable loan program, it will be important to properly utilize any funds your company receives from PPP.

Review the following steps and tactics to comply with the program, maximize the loan forgiveness amount, and provide the greatest benefit to your company. (Note: The US Treasury Department changed several important provisions of PPP while the program was being rolled out, so it is possible that some of the information provided here may change, or that additional guidance may be provided. Business owners must consult their tax, legal, and exit advisors to discuss how this program applies to your specific situation.)

1.Have a plan for how your company intends to use the funds prior to actually receiving them. Once your company receives the funds, an 8-week clock starts ticking. What your company does during this 8-week period determines the loan forgiveness, so it is best to be prepared before the funds are received.

2.Be prepared to carefully document during the 8-week period the company expenses that qualify for loan forgiveness. Your lender will require that documentation to apply for loan forgiveness on your behalf.

3.Create a balance sheet account to keep track of the PPP loan and funds.

4.Deposit the PPP funds into a dedicated bank account. Document as you draw down the funds for eligible expenses to help create a clean audit trail.

5.Carefully monitor how the funds are used, consistent with your plan. To qualify for loan forgiveness, you must use at least 75% of the funds for payroll costs, as defined by the CARES Act. That means you can use up to 25% of the funds for eligible non-payroll costs, which are: rent, interest payments on mortgages, interest on pre-existing loans, and utilities. (Note: For purposes of determining the percentage of use of proceeds for payroll costs, the amount of any Economic Injury Disaster Loan (EIDL) refinanced will be included.)

6.Loan forgiveness may be reduced if either of the following occurs:

a)Employees who made less than $100,000 of compensation in 2019 have their compensation reduced by 25% or more; OR

b)The number of full-time employee equivalents is less than the same number of employees during; either February 15, 2019, through June 30, 2019; OR January 1, 2020, through February 29, 2020—you choose the more favorable period to apply.

(Two important notes here. First, it is unclear at this time exactly how loan forgiveness will be reduced, and we expect further guidance providing some sliding scale. Second, if employee terminations have already occurred, you can hire employees back by June 30, 2020, to still qualify for loan forgiveness.)

7.Avoid utilizing other CARES Act relief programs that nullify participating in PPP, including:

a)The Employee Retention Credit

b)Deferral of Payroll Taxes

8.During the 8-week period that starts immediately after receiving PPP funds, maximize the payment of expenses that qualify for loan forgiveness, for example:

a)Time payroll where possible to maximize payments during the 8-week period

b)Consider paying bonuses to employees who have demonstrated superior job performance during the crisis (remember compensation above $100,000 does not count toward loan forgiveness)

c)Make catch-up payroll payments to any employees whose compensation was reduced as a result of the COVID-19 crisis

d)Make additional or early payments on rent, mortgage interest, or utilities (up to the 25% threshold)

9.Remember that any amount of the PPP funds not forgiven must be repaid within two years, but loan repayment may be deferred for up to six months.

10.There is no penalty for early repayment, but do not rush to repay any loan balance that is not forgiven. Make sure your company’s cash position remains strong until the business crisis has clearly subsided.

11.Avoid any misuse of the funds. Business owners using the funds for fraudulent purposes are subject to criminal charges.

For additional information, download our free C.A.R.E.S. Act Executive Summary, which contains actionable information on the PPP and ten additional major tax, stimulus, and business programs created in response to the COVID-19 public health and economic crisis.

Download Summary

SPECIAL ALERT: Updated C.A.R.E.S Act Executive Summary with New PPP Information

By: Patrick Ungashick

To help our clients and other business owners and leaders respond to the unprecedented leadership disruptions caused by the coronavirus (COVID-19) outbreak, the team at NAVIX offers the following crisis management information series.

Responding to Coronavirus: Updated C.A.R.E.S. Act Executive Summary with new PPP information

Our 11-point Executive Summary of the C.A.R.E.S Act has been updated, to reflect important changes just announced by the Treasury Department and Small Business Administration. Many of these changes deal with the Paycheck Protection Program (PPP) forgivable loan opportunity. Click below to download this important updated resource.

Download Summary

SPECIAL ALERT: Forgivable SBA Loan Application Now Available

By: Patrick Ungashick

o help our clients and other business owners and leaders respond to the unprecedented leadership disruptions cause

d by the coronavirus (COVID-19) outbreak, the team at NAVIX offers the following crisis management information series.

Responding to Coronavirus: Forgivable SBA Loan Application

March 31, 2020 – 4:00pm EST

The US Small Business Administration just released today further information about the new forgivable loan called the Payroll Protection Program (PPP), as well as a loan application form. See the links below to access this information.

Additionally, click here to download our free C.A.R.E.S. Act Executive Summary, which contains actionable information on 11 of the major tax, stimulus, and business programs created in response to the COVID-19 public health and economic crisis.

SBA Information and links:

- Summary of the PPP – click here

- Detailed information for PPP borrowers – click here

- PPP Application form – click here

Be sure to review this information and contact an SBA approved lender to proceed with this program. And contact us if you have any questions.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.