Archive for November, 2019

9 Ways to Maximize Value & Cash When Selling Your Company

Navix Webinar

December 3, 2019 2-3PM EDT

About 70% of business owners expect to exit by selling their company to an outside buyer. Many owners, however, have little to no M&A experience, and thus often don’t fully know what really drives getting top value (and cash!) at sale. This webinar will explain how. You should attend if:

- You intend to sell your company one day when you exit

- You wish to maximize value and cash at sale

- You want to learn how to achieve exit success

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

Why Reaching Financial Freedom at Exit is Absolutely Essential – And How to Get There

By: Patrick Ungashick

Let me share with you three quick and true stories of business owners, and how each failed to achieve and maintain financial freedom at exit.

Story 1 – Joe

When I first met Joe, he was sitting in his desk chair, a broken man. He had sold his trucking company a couple of years earlier, expecting to fully retire. Joe had received some cash at closing, but a large portion of the deal included debt, financed by him. Shortly after selling, the economy had softened, and the new owner made some bad moves in the market. The company plummeted and defaulted on its payments to Joe. As a result, Joe had to take the business back. However, by then, the company was a shell of its former self, and market conditions stunk. To keep it afloat, Joe had to put back into the company much of the cash he had received at closing. Joe was tired. Joe was dejected. Joe was broken.

Story 2 – Neal

Neal was one of several partners in a convenience store company with locations across the midwestern US. Neal and his partners sold for $75 million. Neal netted about $15 million, and at the ripe old age of 50, he then had to find something else to do. We advised him to allocate $10 million to invest a new company while setting aside $5 million for safe, conservative investments. The $5 million, if allocated prudently, could provide for his family for the rest of their lives. Neal agreed with this recommendation. That is, until a few months later, when he purchased a manufacturing business for $30 million, putting all $15 million of his money into the deal.

Neal believed he had the Midas touch when it came to running a company, and he was confident this next one was a future gold mine. The seller also believed the company had a bright future, which is why he only sold Neal 75% of the company, keeping 25% for himself and agreeing to stay involved. Within weeks of the sale, Neal and his new partner were squabbling. Within months they were openly fighting. Lawsuits followed. Revenues fell as customers fled. Profits evaporated as key employees bailed. Neal ended up losing everything.

Story 3 – Dan

Dan was contacted out of the blue by a strategic buyer to acquire his garden equipment manufacturing company. At only $1 million in adjusted EBITDA, Dan’s company was fairly modest in size, but the buyer offered to pay ten times earnings in all cash at closing. Dan could not refuse. After paying off company debt and taxes, Dan walked away with about $5 million.

Entranced by selling for such a large multiple, Dan looked closely at his financial picture only after his exit. When he did, Dan realized that he could not conservatively invest the $5 million and maintain his family’s lifestyle for the rest of his life—he would run out of money. Dan’s three options were to: immediately find new work, cut his standard of living, or invest more aggressively. Dan chose the third option. He invested half of his funds into some raw land he intended to develop. His timing could not have been worse, for only a few months later, the real estate bubble burst. He also invested heavily in a local community bank, which eventually folded when a recession hit. Within a couple of years after selling this company, Dan owned some empty acres, some worthless bank stock, and a few hundred thousand dollars in cash.

Reaching Financial Freedom

All three of the business owners built fine companies. All three exited happily—or so they thought at the time that they exited. All three of them sold their companies for a compelling price. Also, unfortunately, all three of them failed to either achieve or maintain financial freedom.

Financial freedom is not just some buzz phrase, either to business owners or to us. We define it to mean reaching the state where working to generate income is a choice, rather than an economic necessity. Many business owners do not wish to ever fully retire. Entrepreneurs often see themselves “working” for nearly all their lives. Despite that, practically all business owners aspire to reach a point where work is a choice and not a necessity. That is financial freedom. It is the number one goal at exit for the vast majority of owners.

Unfortunately, many owners fail to reach financial freedom at exit, walking away with too little assets and income to meet the need. Other owners seem to have enough at exit only to make any one of several mistakes that set them back into a shortfall. Either way, if you find yourself coming up short, it will be too late to turn back the clock, and you will find yourself facing a list of undesirable choices.

There is only one sure way to reach financial freedom—you must create a valuable company and have a sound exit plan. Both elements are required. Just producing a valuable company is not enough (see the previous stories for evidence.) Building a valuable company without a sound exit plan is like rolling the dice with many chips on the table. You might win, and you might not. Why take that risk?

To help you reach financial freedom, you need a sound exit plan that addresses ALL of the following questions and issues:

- How valuable does your company need to be at exit?

- Are you on track to get there—and if not, what do you need to do about it?

- What makes one company more valuable at exit than another, and how can you maximize value in your company?

- How much money can you safely pull money out of your company between now and exit to reduce risk?

- What can you do to reduce taxes now and at your exit?

- How can you build and execute a post-exit financial plan that reduces risk and preserves financial freedom?

- What will you do in life after exit, and how can you make sure you don’t over-invest or risk too much?

Any exit plan that fails to address each of these issues, thoroughly and carefully, leaves you at risk, and you have worked too hard and achieved too much to come up short.

Our website is full of educational materials on this topic. To help you get started, consider the following free materials:

Cheat Sheet: “What Does an Exit Plan Look Like”

Free Ebook: “The Exit Magic Number™”

Free Webinar: “You Only Get One Shot”

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

Team Strength DISC

Team Strength DISC

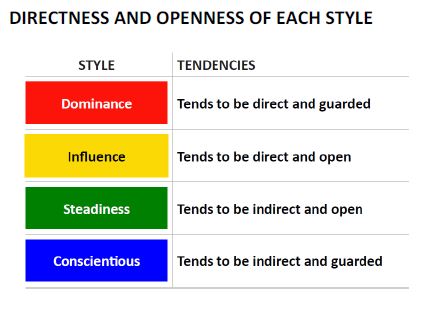

Team Strength DISC is a simple, practical, powerful tool used to understand people. It focuses on individual patterns of external, observable behaviors and measures the intensity of characteristics using scales of directness and openness for each of the four styles:

Dominance

Influence

Steadiness

Conscientious

Using the Team Strength DISC model, it is easy to identify and understand our own style, recognize and cognitively adapt to different styles. The Team Strength charting app makes it easy to develop a process to communicate more effectively with others.

Team Strength DISC a tool to:

- Demystify behaviors

- Improve communications

- Develop strong teams

- Build better relationships

- Facilitate conflict resolution

- Self-growth

Team Strength DISC provides tools to help you become a better you – to develop and use more of your natural strengths while recognizing, improving upon, and modifying your limitations. Then, because we can easily see and hear these behaviors, we can quickly and accurately “read” other people and use our knowledge to enhance communication and grow our relationships.

Historical and contemporary research reveal more than a dozen various models of our behavioral differences, but many share one common thread: the grouping of behavior into four basic categories:

Dominance, Influence, Steadiness, and Conscientious.

There is no “best” style. Each style has its unique strengths and opportunities for continuing improvement and growth.

BEHAVIORAL STYLES

Historical and contemporary research reveal more than a dozen various models of our behavioral differences, but many share one common thread: the grouping of behavior into four basic categories.

The Team Strength DISC styles are Dominance, Influence, Steadiness, and Conscientious. There is no “best” style. Each style has its unique strengths and opportunities for continuing improvement and growth.

The assessment examines external and easily observable behaviors and measures tendencies using scales of directness and openness that each style exhibits.

This is part one of the Team Strength DISC Profiles Series.

Please share this with a friend/colleague

When Apple Lost $10 Billion…And What It Means for You

By: Patrick Ungashick

Back in 2011, when Apple announced the retirement of its founder and visionary leader Steve Jobs, the company’s value immediately fell by about $10 billion. (That’s billion with a B.) This dramatic loss of value occurred even though Jobs’ departure had been expected for some time, and his successor Tim Cook was a highly respected leader already established within the company. Investors were simply too disturbed and uncertain about how the company would fare without Jobs as CEO.

Since then, most of us know that Apple has not only survived, but it has thrived under Cook and other talented leaders. There is an important lesson for business owners with small to mid-market companies: when it is time for you to exit, it must be clear to everybody involved that your company can not only survive your departure but can actually thrive without you going forward. If the company’s leadership is uncertain without you, you find it very difficult to exit happily. Here’s why.

Owner Dependency

We call this issue, “Owner Dependency.” Within many small to mid-sized businesses, the owner is the most valuable and vital employee, and the company is highly dependent on this owner’s involvement. If you lead an owner-dependent company, then your knowledge, relationships, and vision are what drives the business. Undoubtedly you have help—few CEO/owners build a business alone. But much of your company growth has been due to your personal presence and efforts.

None of this is a problem, as long as you have no desire to go anywhere. But, one day, you will wish to exit. If, at that time, you remain an essential employee, you may face several serious challenges that can undermine or outright block your exit. Here are four examples:

Lost Business Value

Apple lost $10 billion when a flood of investors sold their stock upon learning Jobs was stepping down. In their minds at the time, the company was less valuable without him.

The same may happen to you and your company when you exit. If you intend to sell your company one day, buyers may reduce their offer price (or take a pass altogether) if they have questions and uncertainty about the company’s future without you. You might not lose $10 billion, but if buyers reduce their offer price by even a few tenths of a multiple, that can add up to a serious loss of value for you.

If the value loss is severe enough, you might be in jeopardy of never reaching personal financial freedom at exit—which is most owner’s number one exit goal.

Lost Legacy

For most owners, achieving a happy exit is not just about the money. It’s also about making sure that you leave the company in good hands, and that the company is well–positioned for success going forward. A company that may not run effectively without you faces an uncertain future once you exit. Most owners will not want to take that risk.

Lost Control

When you exit from your company, you will want to be in control of how you do this. For example, you will want to exit when you choose to, and not when somebody else dictates. You will also want to transition away from the company in the manner of your control. Some business owners want to make a quick transition, moving on to pursue other interests. Other business owners prefer to stay with the company for an extended transition, staying involved in some supporting role, such as serving on the board of directors. Whatever your preferences, if the company is unable to operate effectively without you, your ability to control your own exit will be restricted or forfeited. You can’t exit on your terms as long as your company needs you every day.

Big Uncertainty About Life After Exit

One of the biggest challenges owners face in life after exit is finding activities and interests that provide meaningful involvement once your role in the company has reduced or ended. If your company is highly dependent on you, typically, that means you rarely or never unplug from the company for any significant period of time, beyond perhaps a brief vacation here or there. Without taking an extended time to unplug, you cannot develop and test-drive your ideas for activities and interests after exit. And, without taking time to unplug, you cannot create an organization that learns how to function without you.

It will not matter how much money you might have in the bank at exit, or how well the company is doing after you exit, if you wake up every day without something engaging and rewarding to do with your time and talent.

Get Started Now

Apple’s setback reveals that all business value is fragile. One of the world’s largest and most admired companies felt the negative impact of being potentially overly dependent on a single leader.

Building a leadership team that can lead and grows the company without you takes time, typically years of focused effort. An important part of any exit plan is developing competent and loyal successor leaders. The sooner you get started, the more likely you achieve a happy exit.

To learn eight tactics to address owner dependency, read this article. And, contact us to discuss your situation and how we help owners like you achieve happy and successful exits.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

In Family-Owned Businesses, Equal is Not Fair and Fair is Not Equal

By: Patrick Ungashick

Do you have at least one child working in your family business, and at least one child who is not working in your business? If you do, and if you want to treat all of your children fairly in your business exit and succession planning, prepare not to treat them equally. Because in exit planning for family businesses, fair is not equal and equal is not fair.

To show why, here’s a true story involving a previous client.A Client Story

Dad and Mom had started a construction company nearly forty years earlier. Along the way, Dad and Mom had raised two children: one Son and one Daughter. Son began working in the company right out of school, and eventually became the company’s President. As part of Dad and Mom’s exit planning, they wanted to pass their business down to the Son eventually.

Other than their company, Dad and Mom owned a modest home, a little cash, and a significant amount of raw land. Dad and Mom were worried that if they gave the business to the Son, which seemed fair to do, then they would not have any means to treat their Daughter equally, which seemed unfair to her. But while splitting up their assets 50/50 between the two children would treat them equally, it seemed unfair to the Son.

At that point in our exit planning, we suggested that Dad and Mom have their the two most valuable assets appraised: the company and the land. Independent appraisers were brought in to value each asset. Purely coincidentally, the company and the land were both valued at almost exactly $5 million each. With this information in hand, we suggested to Dad and Mom that their plan should be to give the business to the Son, and the land to the Daughter. After all, this was nearly perfectly equal.

Upon hearing our recommendation, Mom became upset to the point of tears. She said that she understood this seemed to be an equal solution, but it struck her as unfair—for both of her children. As she explained, the land was undeveloped, pristine forest, and grassland. They used it for hunting and camping. Everyone in the family hoped to keep it for generations to come. Giving the land to the Daughter was not providing her with any wealth or income—actually, they were giving her an annual property tax bill. Compared to the company, the land was a financial burden. That was not fair to the Daughter.

As for the Son, giving him the business seemed the right thing to do. However, Dad and Mom appreciated that even though the company was profitable and generated wealth, it was inherently risky, as construction is a volatile and uncertain industry. The business would require the son to personally guarantee his assets to collateralize debt, whereas the land was debt-free. The company could one day be diminished or worthless through no fault of the Son. In contrast, the land would always exist and likely have at least some value. Furthermore, they wanted the Son and his heirs to also enjoy the use of the land, without forever needing to ask anybody for permission.

For these reasons, giving the Son the business, and the Daughter the land seemed entirely unfair. There seemed no way to treat the children fairly and equally.

Family Business = Complicated

This real-world example is unusually simple: two kids, with one involved in the business, and not participating in the business. Two main assets: the company and the land, both worth the same amount of money from a market value standpoint. Yet, for all this situation’s simplicity, it illustrates the remarkably tricky challenge of being fair to everybody when trying to design and implement an exit plan for family–owned businesses.

Many real-world situations are more complex than what this client faced. For example, things can get even more complicated if any of the following are true:

- There are more than just two kids

- Multiple children work (or have worked) in the business, and thus have competing expectations and interests

- Some children need specialized medical care or have struggled with issues like substance abuse, financial mismanagement, or marital instability

- Dad and Mom have little to no significant assets outside of the company

- Dad or Mom in in poor health, and there may be a need to rush a process

- Not all of the family members get along with one another

The Solution? Focus on Fair, Not Equal

In situations where a family is trying to treat everybody fairly, rarely it is possible or advantageous to treat everybody equally. Typically, you have to be unequal to be fair.

For example, children who have worked in a family business for years usually come to expect that they will one day receive a larger portion of that company than their siblings. That may not be equal, but to many families, this is the right and fair thing to do out of respect for the service and contribution those children working in the company have made to the company. Dividing a company into equal parts among children who have not worked equally in that company rarely produces a stable and happy outcome.

People are different. No two people are identical, and thus no two people are equal in terms of their skills, desires, traits, wants, and needs. Trying to treat people who are not identical equally usually ends up being unfair because they are different people.

Assets are different too. Different assets have inescapably different characteristics and qualities. As the mother from this true story pointed out, $5 million worth of raw land carries very different opportunities and disadvantages compared to $5 million worth of a closely-held business. Cash, marketable securities, commercial real estate, vacation properties—all these assets too are, unavoidably, “not equal,” even if the worth is the same in terms of market value. Again, approaching these assets as equals rarely creates outcomes that will be seen as fair.

There are no one-sized–fits–all solution with family businesses and family members. But, understanding that equal is not fair, and fair is not equal, allows family members to consider solutions that are more likely to be seen as “fair” by everybody involved.

To learn more, watch our free educational webinar or contact us with your questions.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

Cheat Sheet: 25 Ways to Make Your Company More Valuable

By: Patrick Ungashick

wo businesses are of the same size. One sells for twice the price of the other. Why does this happen?

It happens all the time. Take two companies from the same industry and similar size, offer them for sale, and one sells for a premium price compared to the other.

There are factors or conditions within any business that will increase (or decrease) its value at sale. If you are a business owner contemplating selling your company one day, it is essential to know what conditions enhance or detract from company value. These conditions take time to implement or fully realize—sometimes several years or longer. So, the sooner you get started, the better.

Click here to download our “25 Value Drivers” cheat sheet, to see those factors and conditions which enhance (and detract) from value in your company.

Then, contact us to see how we can help you make your company more valuable at exit.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.