Posts Tagged "Sell Business"

Yes! Alternatives to Selling to a Competitor or Private Equity

Perhaps the two biggest myths about selling your company are:

- Your buyer must be a competitor or a private equity firm, and

- When you sell, you must give up control.

Thankfully, neither myth is true.

This educational webinar presents an alternative strategy to achieve the goals that most business owners seek: maximizing personal wealth, maintaining control until you wish to exit, and setting up the company for long-term success.

Register and attend this webinar to learn:

- When it may be right to sell your company to a competitor or private equity group, and when it may be the wrong decision

- How to get cash out of your company without giving up control

- How to position the company for long-term growth and success

Register Now

Contact Tim 772-221-4499, to discuss strategies for your business.

Eager to Sell Your Company When the Market Returns?

Contact Tim 772-221-4499, to discuss strategies for your business.

You Wouldn’t Sell to Just One Customer at a Time, So Why Sell Your Company That Way?

By: Patrick Ungashick

One of the most common mistakes owners make in their exit planning is negotiating with only one potential buyer for their business. Rarely, this works out fine, and the business sells for the desired price. However, more often than not, negotiating with only one potential buyer at a time undermines your exit success—sometimes without even knowing that you lost something.

Here are five reasons why you may come up short if you only talk to one potential buyer at a time:

1.You don’t know if you are talking to the buyer who will pay the highest price.

For most businesses, there are multiple potential buyers out there. Within the universe of potential buyers, some will be more motivated than others to acquire your company. Remember—the buyer’s motive makes the multiple. So, unless you happen to get lucky, the simple odds are that you are not talking to the most motivated potential buyer for your business. Making matters worse, you have no way to recognize if you are talking to the best buyer or not without other potential buyers in the conversation.

2. You also don’t know if you are talking to the buyer who is the best fit for your company.

When selling their business, most owners seek more than just the top price. If you are like most owners, when you go to exit, you will prefer to sell to a buyer that is a good fit for your organization, a buyer that will continue your culture, treat employees fairly, and serve customers well. Again, unless you happen to get lucky, the odds are that you are not talking to the best fitting buyer. And, here too, the only way to know is to include other potential buyers in the conversation.

3.Talking to just one buyer eliminates any competitive pressure in your favor.

If you are negotiating with only one potential buyer, that party knows it has no competition to acquire your company. It has no incentive to put forth its top price or most attractive terms. It has nobody bidding against it. Even if you believe that you want to sell your company to this one buyer, you don’t have a second buyer to create any pressure. Consequently, you have little leverage within the negotiations. Without other potential buyers in the picture, the one potential buyer is mostly free to set the price on its own, dictate the process and timetable, and secure an outcome favorable to itself. The whole situation validates the old saying, “In a potential negotiation between one party with all the money and another party without any, the party with the money will win.” Most potential buyers have a lot more money than you do, and if it’s just you and one buyer in the negotiation, likely they will win.

4.You have little to no protection during due diligence.

During the due diligence phase, some potential buyers look for opportunities and justifications to lower the final purchase price. (This is called “retrading” the deal.) You can attempt to negotiate with your potential buyer to keep the price up, but you have little leverage short of walking away from the negotiations, and your potential buyer will know this. It is easier said than done to walk away from a deal once you are this far along because you will have months invested in transactions, as well as tens of thousands of dollars in expenses and endless emotional capital. With just one potential buyer in the picture, you are at a disadvantage all through the process, but especially during due diligence.

5.Getting your deal done may take more time and present greater risks.

Without competition, your potential buyer feels little pressure to get the deal done. This leaves them in control over timing. The longer your sale takes, the higher the risks for you. For example, something could happen, which gives the potential buyer leverage to lower the price, such as your business misses a monthly sales forecast. Or, a customer or competitor could learn about your potential sale before you are ready. Time is the enemy of all deals. As time increases, the effort and cost you have invested in this possible deal increase, making it harder for you to walk away—a vulnerable position for you. Potential buyers know this, and use it to their advantage.

Your Exit Plan and Selling Your Company

With few exceptions, business owners seeking to sell their company at exit are better served by working with advisors who will run an organized process that confidentially brings multiple potential buyers into the picture. A competitive process creates positive price pressure, increases your options, and likely leads to exit success.

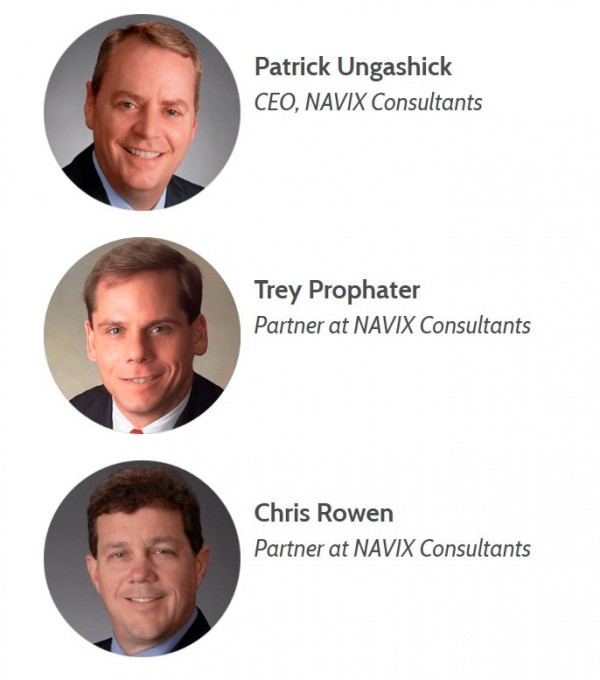

At NAVIX, we have helped hundreds of business owners plan for and achieve successful exits. To learn more about what goes into an exit plan, start here. Or contact us with your questions.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

9 Ways to Maximize Value & Cash When Selling Your Company

Navix Webinar

December 3, 2019 2-3PM EDT

About 70% of business owners expect to exit by selling their company to an outside buyer. Many owners, however, have little to no M&A experience, and thus often don’t fully know what really drives getting top value (and cash!) at sale. This webinar will explain how. You should attend if:

- You intend to sell your company one day when you exit

- You wish to maximize value and cash at sale

- You want to learn how to achieve exit success

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

Why Reaching Financial Freedom at Exit is Absolutely Essential – And How to Get There

By: Patrick Ungashick

Let me share with you three quick and true stories of business owners, and how each failed to achieve and maintain financial freedom at exit.

Story 1 – Joe

When I first met Joe, he was sitting in his desk chair, a broken man. He had sold his trucking company a couple of years earlier, expecting to fully retire. Joe had received some cash at closing, but a large portion of the deal included debt, financed by him. Shortly after selling, the economy had softened, and the new owner made some bad moves in the market. The company plummeted and defaulted on its payments to Joe. As a result, Joe had to take the business back. However, by then, the company was a shell of its former self, and market conditions stunk. To keep it afloat, Joe had to put back into the company much of the cash he had received at closing. Joe was tired. Joe was dejected. Joe was broken.

Story 2 – Neal

Neal was one of several partners in a convenience store company with locations across the midwestern US. Neal and his partners sold for $75 million. Neal netted about $15 million, and at the ripe old age of 50, he then had to find something else to do. We advised him to allocate $10 million to invest a new company while setting aside $5 million for safe, conservative investments. The $5 million, if allocated prudently, could provide for his family for the rest of their lives. Neal agreed with this recommendation. That is, until a few months later, when he purchased a manufacturing business for $30 million, putting all $15 million of his money into the deal.

Neal believed he had the Midas touch when it came to running a company, and he was confident this next one was a future gold mine. The seller also believed the company had a bright future, which is why he only sold Neal 75% of the company, keeping 25% for himself and agreeing to stay involved. Within weeks of the sale, Neal and his new partner were squabbling. Within months they were openly fighting. Lawsuits followed. Revenues fell as customers fled. Profits evaporated as key employees bailed. Neal ended up losing everything.

Story 3 – Dan

Dan was contacted out of the blue by a strategic buyer to acquire his garden equipment manufacturing company. At only $1 million in adjusted EBITDA, Dan’s company was fairly modest in size, but the buyer offered to pay ten times earnings in all cash at closing. Dan could not refuse. After paying off company debt and taxes, Dan walked away with about $5 million.

Entranced by selling for such a large multiple, Dan looked closely at his financial picture only after his exit. When he did, Dan realized that he could not conservatively invest the $5 million and maintain his family’s lifestyle for the rest of his life—he would run out of money. Dan’s three options were to: immediately find new work, cut his standard of living, or invest more aggressively. Dan chose the third option. He invested half of his funds into some raw land he intended to develop. His timing could not have been worse, for only a few months later, the real estate bubble burst. He also invested heavily in a local community bank, which eventually folded when a recession hit. Within a couple of years after selling this company, Dan owned some empty acres, some worthless bank stock, and a few hundred thousand dollars in cash.

Reaching Financial Freedom

All three of the business owners built fine companies. All three exited happily—or so they thought at the time that they exited. All three of them sold their companies for a compelling price. Also, unfortunately, all three of them failed to either achieve or maintain financial freedom.

Financial freedom is not just some buzz phrase, either to business owners or to us. We define it to mean reaching the state where working to generate income is a choice, rather than an economic necessity. Many business owners do not wish to ever fully retire. Entrepreneurs often see themselves “working” for nearly all their lives. Despite that, practically all business owners aspire to reach a point where work is a choice and not a necessity. That is financial freedom. It is the number one goal at exit for the vast majority of owners.

Unfortunately, many owners fail to reach financial freedom at exit, walking away with too little assets and income to meet the need. Other owners seem to have enough at exit only to make any one of several mistakes that set them back into a shortfall. Either way, if you find yourself coming up short, it will be too late to turn back the clock, and you will find yourself facing a list of undesirable choices.

There is only one sure way to reach financial freedom—you must create a valuable company and have a sound exit plan. Both elements are required. Just producing a valuable company is not enough (see the previous stories for evidence.) Building a valuable company without a sound exit plan is like rolling the dice with many chips on the table. You might win, and you might not. Why take that risk?

To help you reach financial freedom, you need a sound exit plan that addresses ALL of the following questions and issues:

- How valuable does your company need to be at exit?

- Are you on track to get there—and if not, what do you need to do about it?

- What makes one company more valuable at exit than another, and how can you maximize value in your company?

- How much money can you safely pull money out of your company between now and exit to reduce risk?

- What can you do to reduce taxes now and at your exit?

- How can you build and execute a post-exit financial plan that reduces risk and preserves financial freedom?

- What will you do in life after exit, and how can you make sure you don’t over-invest or risk too much?

Any exit plan that fails to address each of these issues, thoroughly and carefully, leaves you at risk, and you have worked too hard and achieved too much to come up short.

Our website is full of educational materials on this topic. To help you get started, consider the following free materials:

Cheat Sheet: “What Does an Exit Plan Look Like”

Free Ebook: “The Exit Magic Number™”

Free Webinar: “You Only Get One Shot”

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

In Family-Owned Businesses, Equal is Not Fair and Fair is Not Equal

By: Patrick Ungashick

Do you have at least one child working in your family business, and at least one child who is not working in your business? If you do, and if you want to treat all of your children fairly in your business exit and succession planning, prepare not to treat them equally. Because in exit planning for family businesses, fair is not equal and equal is not fair.

To show why, here’s a true story involving a previous client.A Client Story

Dad and Mom had started a construction company nearly forty years earlier. Along the way, Dad and Mom had raised two children: one Son and one Daughter. Son began working in the company right out of school, and eventually became the company’s President. As part of Dad and Mom’s exit planning, they wanted to pass their business down to the Son eventually.

Other than their company, Dad and Mom owned a modest home, a little cash, and a significant amount of raw land. Dad and Mom were worried that if they gave the business to the Son, which seemed fair to do, then they would not have any means to treat their Daughter equally, which seemed unfair to her. But while splitting up their assets 50/50 between the two children would treat them equally, it seemed unfair to the Son.

At that point in our exit planning, we suggested that Dad and Mom have their the two most valuable assets appraised: the company and the land. Independent appraisers were brought in to value each asset. Purely coincidentally, the company and the land were both valued at almost exactly $5 million each. With this information in hand, we suggested to Dad and Mom that their plan should be to give the business to the Son, and the land to the Daughter. After all, this was nearly perfectly equal.

Upon hearing our recommendation, Mom became upset to the point of tears. She said that she understood this seemed to be an equal solution, but it struck her as unfair—for both of her children. As she explained, the land was undeveloped, pristine forest, and grassland. They used it for hunting and camping. Everyone in the family hoped to keep it for generations to come. Giving the land to the Daughter was not providing her with any wealth or income—actually, they were giving her an annual property tax bill. Compared to the company, the land was a financial burden. That was not fair to the Daughter.

As for the Son, giving him the business seemed the right thing to do. However, Dad and Mom appreciated that even though the company was profitable and generated wealth, it was inherently risky, as construction is a volatile and uncertain industry. The business would require the son to personally guarantee his assets to collateralize debt, whereas the land was debt-free. The company could one day be diminished or worthless through no fault of the Son. In contrast, the land would always exist and likely have at least some value. Furthermore, they wanted the Son and his heirs to also enjoy the use of the land, without forever needing to ask anybody for permission.

For these reasons, giving the Son the business, and the Daughter the land seemed entirely unfair. There seemed no way to treat the children fairly and equally.

Family Business = Complicated

This real-world example is unusually simple: two kids, with one involved in the business, and not participating in the business. Two main assets: the company and the land, both worth the same amount of money from a market value standpoint. Yet, for all this situation’s simplicity, it illustrates the remarkably tricky challenge of being fair to everybody when trying to design and implement an exit plan for family–owned businesses.

Many real-world situations are more complex than what this client faced. For example, things can get even more complicated if any of the following are true:

- There are more than just two kids

- Multiple children work (or have worked) in the business, and thus have competing expectations and interests

- Some children need specialized medical care or have struggled with issues like substance abuse, financial mismanagement, or marital instability

- Dad and Mom have little to no significant assets outside of the company

- Dad or Mom in in poor health, and there may be a need to rush a process

- Not all of the family members get along with one another

The Solution? Focus on Fair, Not Equal

In situations where a family is trying to treat everybody fairly, rarely it is possible or advantageous to treat everybody equally. Typically, you have to be unequal to be fair.

For example, children who have worked in a family business for years usually come to expect that they will one day receive a larger portion of that company than their siblings. That may not be equal, but to many families, this is the right and fair thing to do out of respect for the service and contribution those children working in the company have made to the company. Dividing a company into equal parts among children who have not worked equally in that company rarely produces a stable and happy outcome.

People are different. No two people are identical, and thus no two people are equal in terms of their skills, desires, traits, wants, and needs. Trying to treat people who are not identical equally usually ends up being unfair because they are different people.

Assets are different too. Different assets have inescapably different characteristics and qualities. As the mother from this true story pointed out, $5 million worth of raw land carries very different opportunities and disadvantages compared to $5 million worth of a closely-held business. Cash, marketable securities, commercial real estate, vacation properties—all these assets too are, unavoidably, “not equal,” even if the worth is the same in terms of market value. Again, approaching these assets as equals rarely creates outcomes that will be seen as fair.

There are no one-sized–fits–all solution with family businesses and family members. But, understanding that equal is not fair, and fair is not equal, allows family members to consider solutions that are more likely to be seen as “fair” by everybody involved.

To learn more, watch our free educational webinar or contact us with your questions.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

Why Your Company’s Profitability is Not the Same as Exitability

By: Patrick Ungashick

It’s not difficult to evaluate your company’s profitability—it’s right there, in black and white, in the financial statements. This clarity is beneficial, because company profitability is arguably the single most critical area of business performance. As the saying goes, revenue is vanity but profits are reality. So when you one day want to exit, the more profitable your business, then likely the more valuable it will be at your exit.

But just because your company is profitable, does that mean it is exitable? Admittedly, I made up the word “exitable,” but for a good reason. An exitable company is one that is well prepared for the owner to exit and will fulfill the owner’s business and personal exit goals. Many companies are profitable but not exitable. If your company has any characteristics that limit its exitabilty, when you go to exit you will find the path more difficult than you expected, the company less valuable than you desired, or at worst your exit completely blocked. Moreover, if you only find out all these issues right when you want to exit, it will be too late to do anything about it.

Profitability and exitability are not the same. There are a surprising number of ways that businesses can grow and operate profitably, without necessarily being exitable. Here are four common situations where this can occur:

Owner Dependency

The first common limitation on exitability is owner dependency. If your business is dependent on you, or any other owners, to operate and grow profitably, this typically limits exitability. The company’s value cannot walk out the door when you do. It’s also ironic because your company probably would not be what it is today if you had not worked as hard as you have up to now, perhaps over many years. It’s great to be good at what you do, but if your company is losing an essential employee when you exit, that undermines exitability. It’s not enough either to say that the company could manage to survive without you. It has to be able to thrive without you. Buyers want to know that the business’s profits will not slow down nor go away when you do.

Customer Concentration

The second common limitation on exitability is customer concentration. This statement may surprise you because customer concentration is usually a byproduct of a job well done. Your company may have served one or a few customers well, and they’ve responded by sending more and more business your way. Then, one day, you look around, and 20%, 30%, 50%, or more of your revenue and profits comes from these few customers. These customers might be generating many profits, but customer concentration usually limits exitability. If you intend to sell your company one day, your future buyers likely won’t have longstanding relationships with these customers, creating risk for them. Buyers often pay less for companies with customer concentration or pass on purchasing that company altogether. Customer concentration thus becomes a serious limitation on exitability, no matter how profitable those customers may be.

Co-Owner Goal Misalignment

The third way many companies experience limited exitability is if they have co-owners who are not in alignment with one another. We did a research study a number of years ago and it revealed that 7 out of 10 small to medium-sized privately-owned companies have ownership shared among two or more co-owners. We often see co-owners who are in strong alignment with one another for years and sometimes even decades while they are working together to grow the business because they share one clear priority, which is to increase revenues and profits. The problem arises when one or more of those co-owners get closer to exit because the goals often change and the co-owners find themselves no longer in alignment. For example, one co-owner may want to sell now, while another wants to wait. Alternatively, one co-owner may wish to sell for a lower price, while another wants to keep growing the company and hold out for a higher price. Whatever the situation, when the goals change, the co-owner alignment changes, and often the co-owners don’t even realize it’s happening until close to exit, at which point it can completely undermine a company’s exitability. No matter how profitable your company may be, if the co-owners are not in alignment, exitability will suffer.

Unclear Plan for the Future

The fourth way companies experience reduced exitability, regardless of profitability, occurs if the company lacks a clear, compelling plan for future growth. For a company to be highly exitable, it must offer a buyer or successor a credible and compelling vision for how that company will grow going forward, after your exit. How profitable the company has been up to this point is nice, but what the company is expected to do in the future drives value and exitability.

Many profitable companies don’t have the systems and habits that help create this compelling plan for future growth. For example, the company leadership team might not do robust strategic planning, or perhaps they do not diligently measure monthly or quarterly performance against financial budgets and operational benchmarks. Without experience doing effective strategic planning, and without a clear track record of being accountable for achieving business goals, it may be unclear to the future buyer or successor whether or not this company can sustain its future growth after your exit. This lack of management practices undermines exitability, even if the profitability has historically been excellent.

Conclusion

These are just four situations that can limit a company’s exitability—and they are prevailing. Growing profits, and getting a company ready for exit, are two different needs. To learn more about preparing your company for exit, consider this educational webinar or contact us with your exit planning questions.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

10 Questions to Answer Before Replying to an Inquiry to Buy Your Company

By: Patrick Ungashick

If you are like most business owners, you probably receive a steady flow of emails and phone calls seemingly offering to buy your company. As you know, many of these inquiries are junk, coming from somebody on a fishing expedition—and you don’t want to end up on that hook. But, how do you know if an inquiry is legitimate and you should consider replying? You could miss a golden opportunity. Then, if you should reply, what’s the right way to respond without appearing too eager, or without revealing sensitive information to a competitor? The wrong move here could ruin a potential deal, or put your company at risk, or waste much time.

To know what to do when a potential buyer contacts you, you must first verify if the inquiry is legitimate. Then, you need to make sure that you are ready for the stream of questions that will immediately come your way.

Step One – Determine if the inquiry is legitimate.

If you already know the party contacting you, and you know they are a legitimate buyer (or represent one), then you can skip this step. Otherwise, you have to determine who the inquiry is from to evaluate its legitimacy. If the inquirer is vague or guarded about their identity, then it is a waste of your time. For example, be wary of obscure phrases such as “I am working with several buyers…” or “I represent a buyer looking to make acquisitions in your industry…” As long as the inquirer will not disclose who they are (or whom they represent), you probably should not respond.

However, if the person or company contacting you openly discloses their identity, usually you can quickly determine the inquiry’s quality with a little online research in three ways:

- Visit their website(s) to learn about who they are

- Google the person and/or organization to see if any recent events have occurred regarding this person or company, most helpfully if they have been involved with any recent transactions

- Look up the person(s) in LinkedIn to read their credentials and background

Generally, you want to make sure that this person and/or company is established and credible. For example, if their website is “Under Construction,” then probably you should delete the inquiry and go back to work. Or, if they have a website but it hypes only transactions they have done in an industry totally different from yours, then delete and go back to work. Or, if the person who contacted you has a LinkedIn page featuring the bright shining face of somebody fresh off a college campus, then probably delete and go back to work.

If you do not uncover anything that concerns you, proceed to the following ten essential questions to know if you are prepared to talk to a potential buyer.

(Disclaimer: At this point, you should enlist the help of professional advisors who have experience in these situations—people like us. Your company is too valuable and important not to have the best team working for you. However, at NAVIX, we genuinely want to help all business owners, so here are the remaining steps if you intend to do this yourself.)

Step Two – Evaluate if you and your company are ready for this conversation.

There are many risks associated with responding to an inquiry if you and your company are not ready. One is lost time and focus. Potential buyers are notorious for chewing up business owners’ time with ever-expanding information requests. Today, they only want your financials. Next week, they’ll be asking for your customer lists and pricing model. Many buyers look at dozens of companies for each one they seek to buy. So, there is a high probability that you will expend a lot of effort and achieve nothing. A second risk is revealing sensitive information to a potential competitor. Even providing your company’s basic financial information tells a competing organization a lot about your operations, strengths, and weaknesses.

Unfortunately, many business owners wing it when responding to unsolicited inquiries. This practice rarely leads to a successful outcome. To be ready to respond to an unsolicited inquiry, at a minimum, you must know the answers to the following 10 questions. There are many more steps involved to get you and your company ready for sale, but these ten are “go or no-go” issues. Meaning, you must know the answer to these ten questions to consider replying to one of those emails or returning one of those phone calls. If you don’t know the answer to even one of these questions, you will likely reveal to a potential buyer that you are inexperienced (and thus vulnerable) or disorganized (and therefore either not worth pursuing, or not worth top dollar). The ten questions are:

- Do you know your company’s adjusted EBITDA for the prior three years and year-to-date? Most transactions are valued at a multiple of adjusted EBITDA. You could be significantly understating the value of your company if you are talking to potential buyers without having properly adjusted (or “normalized”) your EBITDA.

- Do you have a feel for what multiples companies in your industry are currently selling for, beyond rumors and boastful country club talk? If you talk to a potential buyer but don’t know the current multiples in your industry, you don’t know if your buyer is offering you a strong price or bottom fishing.

- Regarding multiples, do you know specifically what drives value in your industry? Have you addressed the things that position some companies to trade at premium EBITDA multiples relative to their peers, while others sell at discounts? The answers can vary across different industries and company sizes.

- Do you know the post-tax amount you would need to sell to achieve financial freedom? Bad guesstimates on that front can lead to passing on reasonable offers, or worse, needing to find post-exit employment. We call this your Exit Magic Number™.

- Are your financial statements bullet-proof? Are your income statements, balance sheets, budgets, and projections readable, credible, formatted to industry specifications, and optimized to maximize value? Many are not. It’s not sufficient that you understand your financials—will a buyer understand and accept them?

- Have you identified all the critical sales, operations, and financial metrics that could potentially scare off a buyer? Are they all trending positively?

- Are all your legal documents current and aligned with a potential sale? That is especially relevant if you have business partners. Just because you own a majority of the stock does not necessarily mean you have authority to sell the entire company. You don’t want to open up the discussion with a potential buyer only to learn your partnership and/or operation agreements don’t address a company sale, which many do not.

- Do you know the information that a buyer will likely request? Buyers initially start with a few documents they ask to see upfront, and then quickly expand to asking for a few dozen and more. Are they organized and readily available? Does your team have the bandwidth to respond to these requests promptly?

- Speaking of your team, if you start talking with a potential buyer, are you prepared to tell the key people on your team? The process with a potential buyer will usually not get very far without help from key managers. Also, buyers will see an increased risk if you are avoiding to include key managers in the process.

- Are you comfortable flying blind? In other words, are you willing to give up the leverage and knowledge that is lost when you deal with a single buyer? Most business owners understand the loss of leverage, and you may decide that you retain the ultimate advantage by being able to walk away from a deal. However, the loss of knowledge can be more problematic. Specifically, how will you know if you should walk away from this buyer? If, after a few discussions, the buyer offers $25 million, how do you know if that’s the best you could do, or if it is even a fair offer? By going down the path with a single buyer, you don’t know if another buyer would have offered you $20 million, or $30 million, or $50 million.

The lack of knowledge is not just about price. Maybe halfway through due-diligence, you are not so excited about this buyer’s plans for your company or your people. If you are talking with only one buyer, you don’t have another buyer to compare their plans for the company. Leverage is essential, but knowledge is power. You will give up that power when they follow through on unsolicited offers.

If you can answer affirmatively to these ten questions—actively, clearly, and unequivocally—then it may make sense to respond to an unsolicited inquiry which you believe to be legitimate. You will still have dozens of more things to do from here, but you should at least be off to a solid start. However, if you cannot answer affirmatively any one of the ten questions presented above, it may be too risky, and it may cost you too much lost time to reply to any of these emails or phone calls. Instead, use your time to get you and your company ready, so that you can properly reply to a future inquiry. To do this, contact us to learn how we can help you as we have helped many hundreds of other business owners achieve successful and happy exits.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499.

Seven Reasons Why Selling Just a Piece of Your Company Might Make Sense

By: Patrick Ungashick

Business owners often think about exit as an all-or-nothing event. For example, “Should I sell my company?” is a more commonly asked question than “How much of my company should I sell?” Yet in many situations selling only some of your business can achieve many of your exit goals, while leaving you owning a portion (and perhaps even a controlling portion) of your business. Here’s how.

The Basics of Partial Company Sale

Selling less than 100% of your company to an outside buyer/investor is usually called a private recapitalization, or recap for short. Any amount can be sold, and private recaps occur where the buyer acquires anywhere from 10% to 90% of the target company. A critical question is whether the buyer acquires a controlling interest in the company, meaning, of course, more than 50% of the voting stock. However, buyers who acquire less than 50% will still negotiate into the deal-specific ownership rights, called supermajority rights, that give them a direct say in strategic issues such as whether or not the entire company is to be sold. Therefore, whether or not you sell more than 50% largely impacts who is in charge of the day-to-day operations of the company.

Potential buyers include wealthy individuals, private equity groups (PEGs), family offices, and sometimes other companies that see a strategic fit with your business. Buyers will often use a combination of equity and debt when they purchase a portion of an operating company.

Advantages of Selling a Piece of Your Company

Business owners are often surprised by the powerful advantages that can come with a partial sale of their company. Listed below are the seven most common and relevant:

One: Get Cash and Reduce Personal Risk

Probably the number one benefit of a partial sale is it offers an opportunity to convert some (but not all) of your ownership into personal cash. Private recaps are often described as “taking some chips off the table” for this reason. Getting cash increases personal liquidity and diversifies one’s assets, which in turn reduces stress and risk! Partial sales additionally reduce personal financial risk by often removing personal guarantees on company debt.

Two: Keep a Portion of the Company for a Later Sale

Typically, the second most attractive benefit of a private recap is you maintain some ownership in the company to sell the rest of your ownership at a later date after the company has hopefully increased in value with continued growth. In this way, private recaps are often described as opportunities to “take a second bite of the apple.”

Three: Stay Involved with the Business…Or Not

Another powerful advantage is you can customize your involvement in the business after the partial sale. If you want to remain fully involved in the business’s leadership and management, you potentially can. Or, if you wish to scale back your participation to a purely strategic or advisory role, such as serving on the board of directors, that too is commonly done. It is even possible to completely step down from all involvement in the company management or leadership and become a “silent investor.” This benefit allows you to pursue any degree of involvement—as long as your buyer agrees with and supports the plan. Perhaps the most common scenario is selling a portion of the company but remaining involved with day-to-day leadership, especially if you intend to enjoy that second bite of the apple later in the future. (Watch our recent webinar called “Cash Out Without Walking Out” webinar to learn more.)

Four: Secure Different Outcomes for Different Owners

If you have business partners, a private recap can allow different owners to pursue and potentially achieve separate and seemingly incompatible individual goals. For example, perhaps one owner is older and seeks to sell some to all of his or her ownership, but another owner is younger, eager to stay involved, and wants to increase his or her ownership. A partial sale can potentially accommodate these differing goals, whereas a full company sale could not.

Five: Create an Equity Path for Top Employees

Another advantage of the partial sales is the ability to create an equity sharing plan for top employees who currently lack ownership. Within a partial company sale, an equity pool can be created to incentivize top employees.

Six: Gain a Powerful Partner

With any partial sale, a new business partner enters the picture—the person or organization who purchases the partial interest. Ideally, this partner brings skills, knowledge, resources, and opportunities that your company leverages into accelerated growth. In the best scenario, this new partner can revolutionize your company’s future: providing capital for expansion or acquisitions, opening doors to new markets, introducing cutting-edge technology, or injecting industry-leading leadership and experience. More modest benefits can include operating cost reductions and efficiency gains if the partner brings larger economies of scale or greater market credentials.

Seven: Achieve Your Exit Goals

A partial sale of the business can be a key tactic in exit planning to achieve your exit goals. If you are like most business owners, at exit you seek to reach financial freedom, exit on your terms, and leave the company in good hands. Whether you ultimately intend to sell the company to an outside buyer, sell to your management team, or give the business to your kids, a partial sale can secure your major goals.

Conclusion and Next Steps

Private recaps are not for every owner or every company. Buyers/investors look for consistently profitable companies that, offer strong growth potential, and have capable leadership. Another point to consider: a partial sale may receive a lower valuation multiple than might be achieved with a full sale, especially if the buyer is only acquiring a minority position. However, this potential disadvantage is offset with the opportunity to pocket some liquidity now and retain ownership for the full sale at a later date—hopefully at a higher total valuation after having grown the company to the next level.

Next time you find yourself asking, “Should I sell my company?” consider rephrasing that question to read “How much of my company should I sell?” Contact us to get help answering this critically important question.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499.

Three Reasons to Take the Surplus Cash Out of Your Company

By: Patrick Ungashick

Too many business owners leave more cash in their company than is necessary. Surplus cash inside the company can cause present and future problems. Here’s how.

First, How Much Cash Does Your Company Need?

Owners and their company’s financial leaders need to answer the question of how much cash the company needs. There are no absolute rules, and every company and industry have specific considerations. Also, how much cash the company needs will change with time as the business grows, market conditions evolve, access to credit changes, etc. While in some cases, the cash question may be difficult to answer; ‘difficult’ does not mean impossible. Leadership teams (with help from outside financial advisors, if needed) must review the company’s recent operations and expected future activities, and then discern how much cash the company needs to meet its operational requirements and growth objectives, with room for a conservative reserve. Many companies have not carefully conducted this analysis or may be working from out-of-date assumptions and paradigms. Once the leadership team has identified the target cash needed, owners should distribute any cash surplus unless there are extenuating reasons not to do so.

There are several reasons why companies might sit on too much cash. A commonly heard justification is holding extra cash helps the owner feel “safe.” Cash is king in times of trouble, so having money readily available in the company’s bank account helps many owners sleep at night. Additionally, many business owners treat “debt” as an altogether bad word. Consequently, the company must hold onto extra cash if there is no sufficient line of credit or other facilities when short term cash is needed. Finally, within entrepreneurial-led companies hoarding cash can be a habit left-over from the days when the company was young and fragile, and founder-owners kept excessive funds as a survival tactic.

Despite these issues, keeping surplus cash in the company is often counterproductive to both immediate and long-term objectives. There are three significant reasons why.

1.Cash in the Company is Exposed to Creditors

Ironically, the feeling that keeping cash in the company increases safety is misplaced. Cash held inside your company is exposed to business creditors, whereas cash held personally is not (unless specifically pledged such as under a personal guarantee). Creditors can be known, like your bank, vendor, or landlord, or can be unknown, acting as a disgruntled former employee or disappointed customer who is preparing to bring a claim against the company. The safest place for cash is likely outside your company.

2.Taking Cash Home Reduces Personal Stress

Many business owners have the majority of their net worth tied up in their company and its supporting assets. This concentration may have caused you little stress when you were younger and tolerated the risk, and when the company’s value was modest. Over time, however, the company grows in value while simultaneously, you get older and perhaps become less risk tolerant. Having a large portion of net worth tied up in the company eventually develops into a stressful situation, for both you and often your family members who share in this risk. Distributing excessive cash can reduce an owner’s stress level and help family members find greater peace of mind.

We see this frequently. A recent former client had a net worth of about $15 million, of which $12 million was the estimated value of his company and the balance mostly tied up in real estate. Troubled by his concentration and illiquidity, the client was rushing to sell some or all of his company. Before committing to a sale, we helped the client identify that his company was sitting on about $2 million in surplus cash. After some cajoling, the client agreed to take a one-time distribution for this amount. After taxes, the client had nearly $1.5 million sitting in his personal bank account. His eagerness to sell the company cooled, and he adopted a more disciplined and less emotional approach to his exit plans.

3.Excessive Cash in the Company Causes Problems at Sale

Excessive cash in the company can become a problem when selling the company. Buyers don’t want to purchase a company stripped bare of cash or cash equivalents—the business must have sufficient working capital to support its operations and expected growth. The funds required to support current and planned operations generally will remain in the company at sale, and thus go to the buyer. Any cash not needed for working capital will be a surplus and typically goes with you the seller.

You can foresee the issue—how much working capital needs to be left in the company will be a point of discussion (and likely negotiation) between you and your buyer. To the extent that you have left more cash in the company than it truly warranted, you have made it easier for the buyer to argue that a more considerable amount of money must be left in the business. That’s the value you would lose. If you find yourself in this situation, to avoid losing that cash, you can have an accounting firm review and reconstruct the company’s actual working capital needs—an expensive project in most cases. The alternative and better solution are to avoid the problem in the first place by not leaving surplus cash in the company.

Getting ready for exit often involves taking steps that seem contrary to how you have managed your company, and your preparations must start no later than five years before you intend to exit. Holding onto too much cash ironically can make it more difficult to exit successfully.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.