Posts Tagged "COVID-19"

Communicating in Times of Crisis Part 2- D Style

As we continue living in highly stressful times; I hope this message finds you well.

Now that so many of us are working remotely, we are finding communication much more challenging. Even with video conferencing tools, it is still difficult to observe and process all of the nonverbal cues that we used to depend on for communication with coworkers, customers, and vendors.

This is part 2 of Communicating in Times of Crisis- focusing on the D Style in the Team Strength DISC Tool.

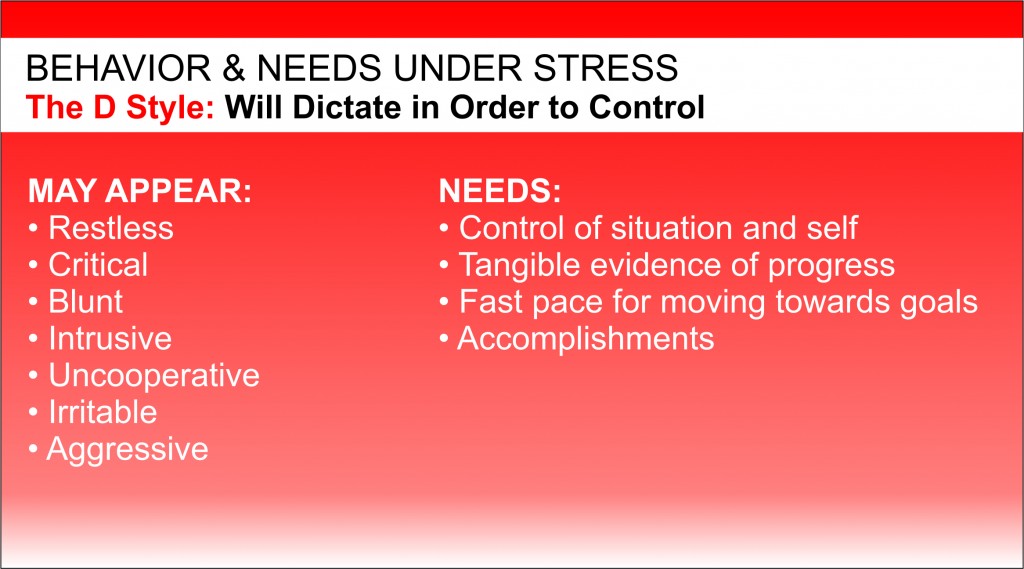

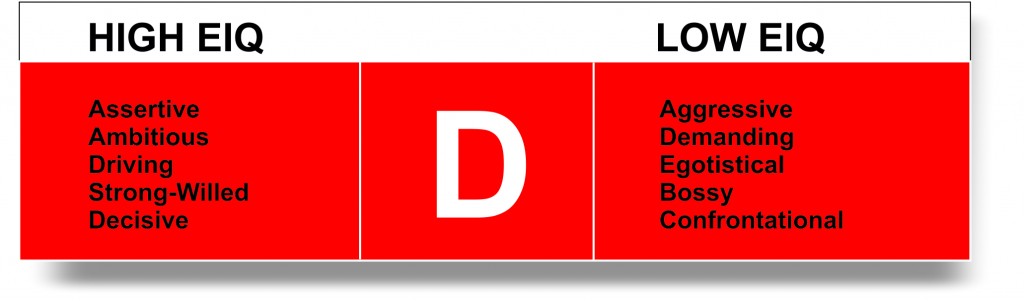

A decisive and ambitious person can become more aggressive and confrontational when things are out of control.

D Style

-

decisive

-

ambitious

-

results driven

-

likes being in charge

When we identify and control what is likely to stress us we can better react with thoughtfulness. (That is a good time to take a nice, deep breath.)

It is OK to understand and accept that we are under stress and not in a comfortable place. That will start to refill our emotional bank account when we need it most.

D Style

Emotional/Reactive: “If you can’t stand the heat, get out of the kitchen.”

Thoughtful: “I understand this is stressful. Let’s focus on what we CAN control.”

When we can get our own emotions controlled by understanding and managing the things that we can affect, then we will be in a better position to help others. By communicating more effectively and reducing our reactive behavior, we will be in a better position to be more accommodating to those around us, on phone calls or in a video chat.

We can then remember to treat others the way they want to be treated. Don’t try to “fix” people. We can remember that they have different needs and fears and we can adapt ourselves to their pace or priority as best we can. It’s a time that we all need to listen more and pay attention to what other behavioral expressions we are broadcasting and being more accepting of the reactions of others.

So, in these troubling times, we do have the ability to make deposits to our own emotional bank account. Even better, when we pay attention and care for others, we can also make emotional deposits to the accounts of those people who are important to us.

Stay safe, stay well.

Tim

Read the full article Communicating in Times of Crisis .

Send your questions about how to use your profile to identify and control what is likely to stress you sot that you can better react. Email

Call 772-210-4499 to set up a time to talk about tools and strategies that will lead to better results.

Here is an easy way to know that your team is ready to get back work.

We need to get back to work. Here is an easy and free way to get everyone on your team on the same page with basic safety training.

Check it out:

https://www.firstresponse-ed.com/stay-safe/

Use code STAYSAFE2020 for FREE access to our Airborne Pathogens Course

Free Airborne Pathogens Workplace Safety eLearning Course.

As restrictions on businesses start to ease, we all want to get back to work and start generating revenue again. However, we must proceed with caution. COVID-19 is still with us, so it is vital to ensure that both employers and employees are equipped with the proper tools necessary to reduce the spread of the virus. The most important of these tools is a proper education on what the virus is and how it moves from person to person.

Here is a short video

Stay safe, stay well.

Tim

Please share this with a friend/colleague

How to Maximize Your PPP Funds

By: Patrick Ungashick

To help our clients and other business owners and leaders respond to the unprecedented leadership disruptions caused by the coronavirus (COVID-19) outbreak, the team at NAVIX offers the following crisis management information series.

Responding to Coronavirus: How to Maximize Your PPP Funds

Despite widespread stories of a chaotic rollout of the CARES Act Payroll Protection Program (PPP), some of the first companies to apply have received their funds. With millions of eligible companies expected to apply for this forgivable loan program, it will be important to properly utilize any funds your company receives from PPP.

Review the following steps and tactics to comply with the program, maximize the loan forgiveness amount, and provide the greatest benefit to your company. (Note: The US Treasury Department changed several important provisions of PPP while the program was being rolled out, so it is possible that some of the information provided here may change, or that additional guidance may be provided. Business owners must consult their tax, legal, and exit advisors to discuss how this program applies to your specific situation.)

1.Have a plan for how your company intends to use the funds prior to actually receiving them. Once your company receives the funds, an 8-week clock starts ticking. What your company does during this 8-week period determines the loan forgiveness, so it is best to be prepared before the funds are received.

2.Be prepared to carefully document during the 8-week period the company expenses that qualify for loan forgiveness. Your lender will require that documentation to apply for loan forgiveness on your behalf.

3.Create a balance sheet account to keep track of the PPP loan and funds.

4.Deposit the PPP funds into a dedicated bank account. Document as you draw down the funds for eligible expenses to help create a clean audit trail.

5.Carefully monitor how the funds are used, consistent with your plan. To qualify for loan forgiveness, you must use at least 75% of the funds for payroll costs, as defined by the CARES Act. That means you can use up to 25% of the funds for eligible non-payroll costs, which are: rent, interest payments on mortgages, interest on pre-existing loans, and utilities. (Note: For purposes of determining the percentage of use of proceeds for payroll costs, the amount of any Economic Injury Disaster Loan (EIDL) refinanced will be included.)

6.Loan forgiveness may be reduced if either of the following occurs:

a)Employees who made less than $100,000 of compensation in 2019 have their compensation reduced by 25% or more; OR

b)The number of full-time employee equivalents is less than the same number of employees during; either February 15, 2019, through June 30, 2019; OR January 1, 2020, through February 29, 2020—you choose the more favorable period to apply.

(Two important notes here. First, it is unclear at this time exactly how loan forgiveness will be reduced, and we expect further guidance providing some sliding scale. Second, if employee terminations have already occurred, you can hire employees back by June 30, 2020, to still qualify for loan forgiveness.)

7.Avoid utilizing other CARES Act relief programs that nullify participating in PPP, including:

a)The Employee Retention Credit

b)Deferral of Payroll Taxes

8.During the 8-week period that starts immediately after receiving PPP funds, maximize the payment of expenses that qualify for loan forgiveness, for example:

a)Time payroll where possible to maximize payments during the 8-week period

b)Consider paying bonuses to employees who have demonstrated superior job performance during the crisis (remember compensation above $100,000 does not count toward loan forgiveness)

c)Make catch-up payroll payments to any employees whose compensation was reduced as a result of the COVID-19 crisis

d)Make additional or early payments on rent, mortgage interest, or utilities (up to the 25% threshold)

9.Remember that any amount of the PPP funds not forgiven must be repaid within two years, but loan repayment may be deferred for up to six months.

10.There is no penalty for early repayment, but do not rush to repay any loan balance that is not forgiven. Make sure your company’s cash position remains strong until the business crisis has clearly subsided.

11.Avoid any misuse of the funds. Business owners using the funds for fraudulent purposes are subject to criminal charges.

For additional information, download our free C.A.R.E.S. Act Executive Summary, which contains actionable information on the PPP and ten additional major tax, stimulus, and business programs created in response to the COVID-19 public health and economic crisis.

Download Summary

Business Response to the Coronavirus Crisis – Tax-Free Aid for Employees Share

By: Patrick Ungashick

To help our clients and other business owners and leaders respond to the unprecedented leadership disruptions caused by the coronavirus (COVID-19) outbreak, the team at NAVIX offers the following crisis management information series.

Responding to Coronavirus: Tax-Free Aid for Employees

With the coronavirus crisis continuing to evolve, employees across the country are facing increased financial stress and uncertainty. Now that the coronavirus crisis has been declared a national emergency, employers have access to a little-known tool called “qualified disaster payments” to aid their employees. These payments can be tax-deductible to the company and income-tax-free to the employees.

Under Internal Revenue Code (IRC) Section 139, companies potentially can reimburse or provide employees with tax-free qualified disaster payments for expenses not covered by insurance, such as:

- Over-the-counter medications

- Hand sanitizers and home disinfectant supplies

- Child care or tutoring due to school closings

- Work-from-home expenses (like setting up a home office, increased utility expenses, higher internet costs, printer, cell phone, etc.)

- Increased costs from unreimbursed health-related expenses

- Increased transportation costs due to work relocation (such as taking a taxi or ride-sharing service from home instead of using public mass transit)

Section 139 expense reimbursements or payments should not replace wages, nor used for non-essential or luxury items or services.

Qualified disaster payments are federal tax-free to employees and are deductible to the employer. There is no federal reporting or disclosure, so these payments are not reported on Form W-2 or 1099 and are not subject to federal income or payroll tax withholding. However, qualified disaster payments may still be treated as wages under state unemployment insurance tax. Employers should determine on a state-by-state basis whether income tax withholding and/or unemployment insurance tax contribution obligations may arise in connection with Section 139 payments.

Additionally, Section 139 does not cap the amount or frequency of qualified disaster payments that can be made to any individual employee or all employees in the aggregate. Employers are not legally required to have a formal program to utilize Section 139. Still, some written plan is recommended to communicate the plan and set guidelines on how and when payments to employees may be made.

Like with any tax matter, employers should consult their tax advisors to discuss how Section 139 applies to them and their situation.

If you are already a NAVIX client, your advisor stands ready to help you discuss additional strategies to protect against the loss of key employees. If you are not a NAVIX client, work with your advisors or contact us about our services.

The NAVIX team has helped hundreds of business owners prepare for exit. We have also helped countless owners and leaders deal with recession, liquidity crises, and economic upheaval. Our experience and perspective enables us to guide our clients through difficult times such as these.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.