Uncategorized

Communicating in Times of Crisis

Even when money is tight and the future is uncertain, remember to keep making deposits to your emotional bank account.

We are all living in highly stressful times; I hope this message finds you well.

Now that so many of us are working remotely, we are finding communication much more challenging. Even with video conferencing tools, it is still difficult to observe and process all of the nonverbal cues that we used to depend on for communication with coworkers, customers, and vendors.

Some of you that are working from home are fortunate to have your family with you. But by now you know that the additional job titles of teacher, cook, entertainer, etc., come with their stress-inducing challenges.

What to do?

First:

Breathe. Nice long relaxing breaths…

What we know about DISC in our own personality can help us, and those we care about, through the new abnormal.

When stress is present, people seek to reduce it, often by dumping it on the person “responsible” for the tension, which is unproductive. Each personality style has its own characteristic manner of “dumping” stress on another.

We all have stress-inducing situations that come and go in our lives. Lately, for most of us, the stress has been sticking around a lot longer. In crisis situations stress is amplified. Behavioral expressions can change, and behaviors may intensify. We need to be ever more vigilant in our interactions with those we care about and those who are dependent on us in our work and at home. This is not easy. Even people with highly developed emotional intelligence (EIQ) are struggling.

Emotional intelligence refers to the capacity to be aware of, control and express our emotions as well as understanding the emotions of others. Empathy is an important characteristic of high EIQ but can be very difficult to display when we are stressed and outside of our comfort zone. Identifying and addressing the characteristic fears of our personality type will help to avoid some of the rough spots. Those rough spots can drain your emotional bank account and reduce your EIQ.

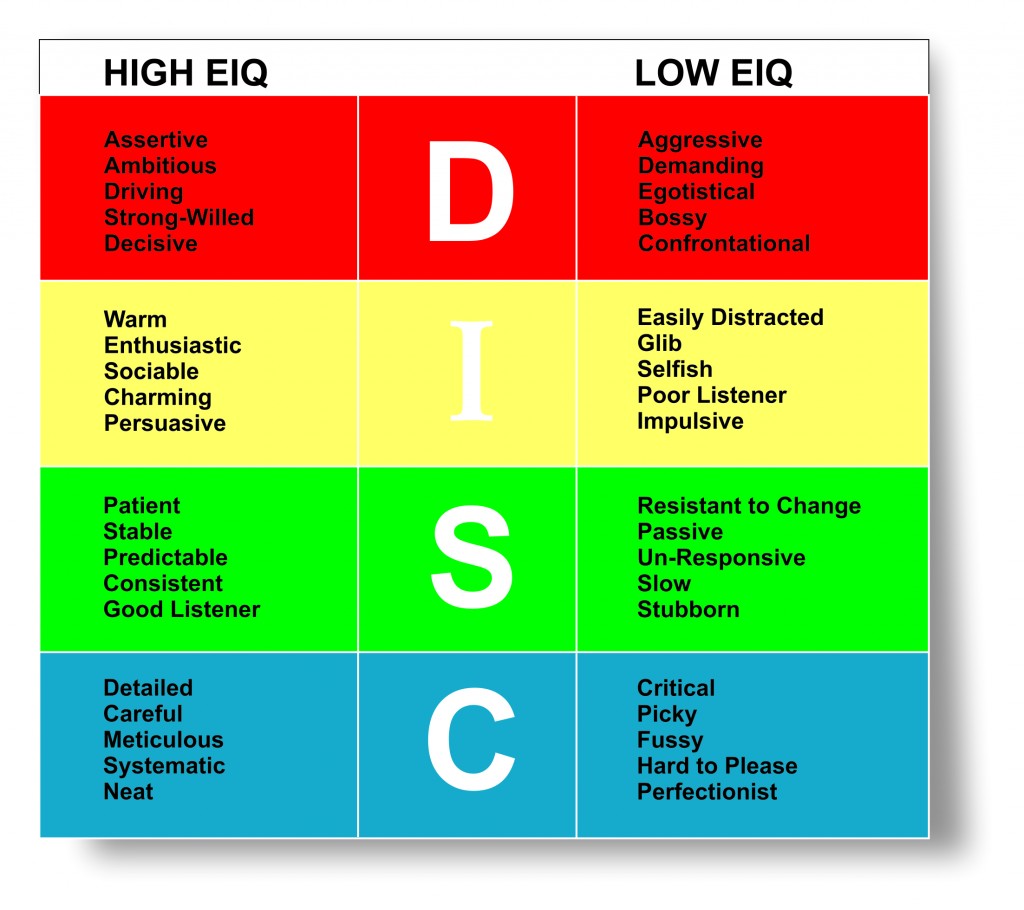

The chart below shows how a reduced EIQ can negatively impact personality traits:

DISC + EMOTIONAL INTELLIGENCE

If you found yourself migrating toward the right side of the chart recently, you are not alone. Without being conscious of the change:

- A decisive and ambitious person can become more aggressive and confrontational when things are out of control.

- A normally sociable and charming individual can become glib and distracted without enough opportunity for social interactions.

- A patient, stable person can become stubborn or even un-responsive when there is no system or the normal pace of their life is disrupted.

- A careful, neat person can become very critical and fussy when new rules or restrictions are unclear or not universally adhered to.

The good news is that you can adapt back to more positive traits. Identify the cause of the stress, based on your personality type, and address it.

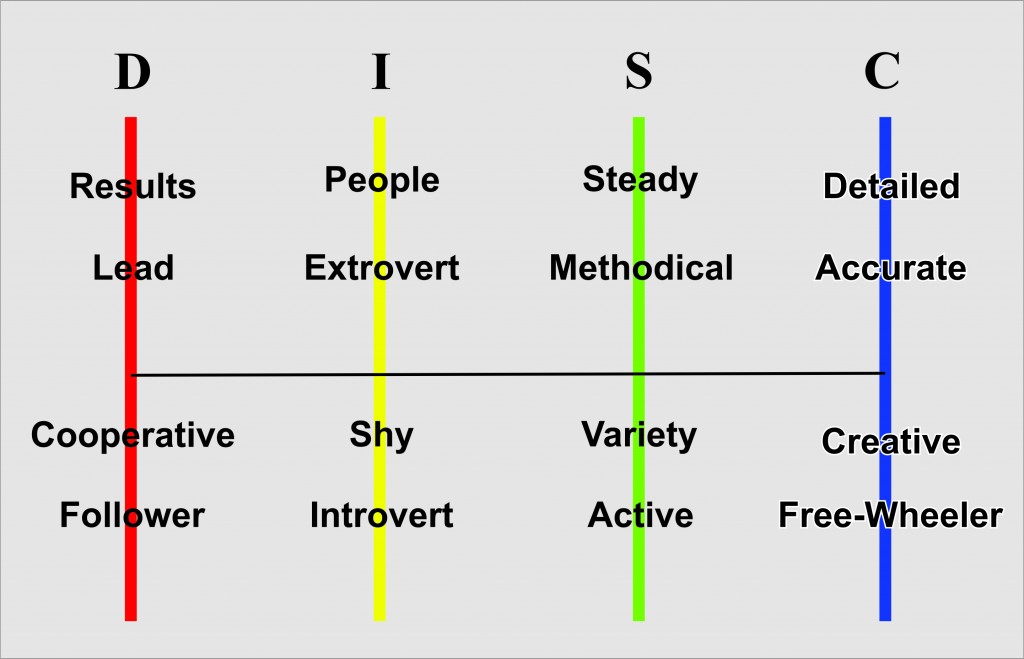

Take some time to review your Team Strength DISC profile. If you do not have a profile, then take a look at the graphic below with some broad descriptors of each of the DISC personality types. Find the broad descriptor that matches your personality best, keeping in mind that there may be two different areas that apply, and use that as your guide.

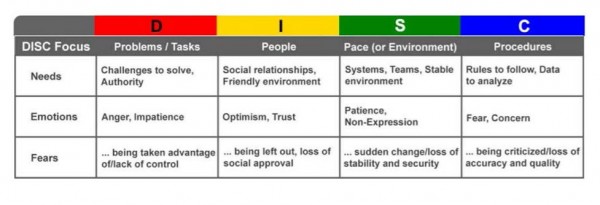

Your Team Strength DISC profile will describe in detail your personality type and highlight some of the drivers that you react to, what you need and also some of the fears that can affect you. The chart below summarizes three key areas in each of the four profile styles.

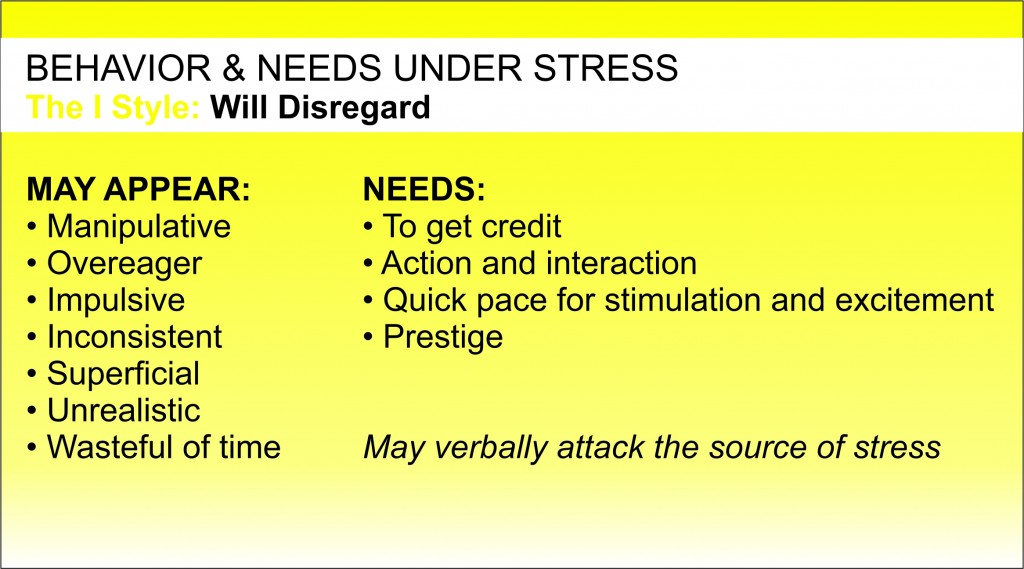

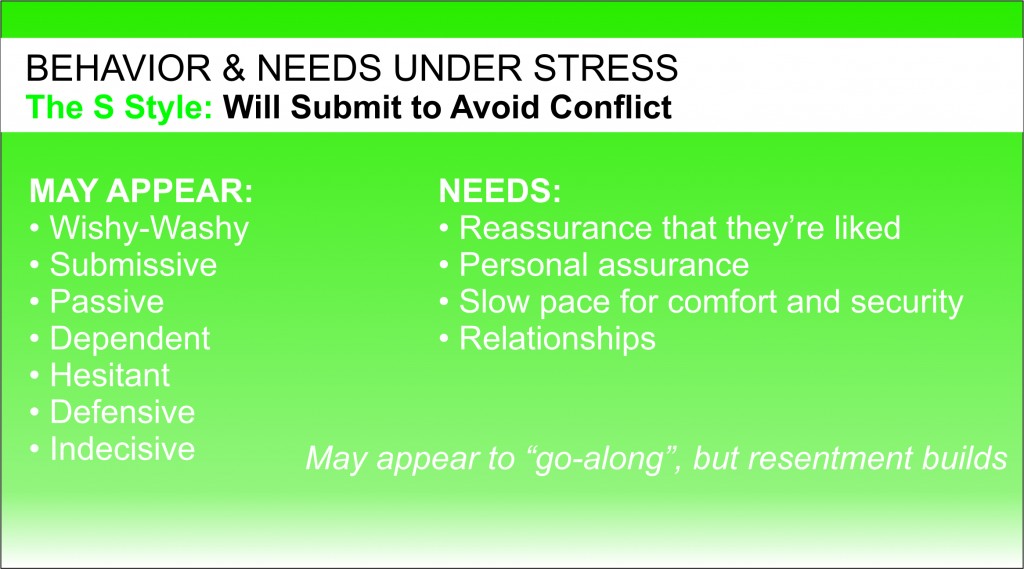

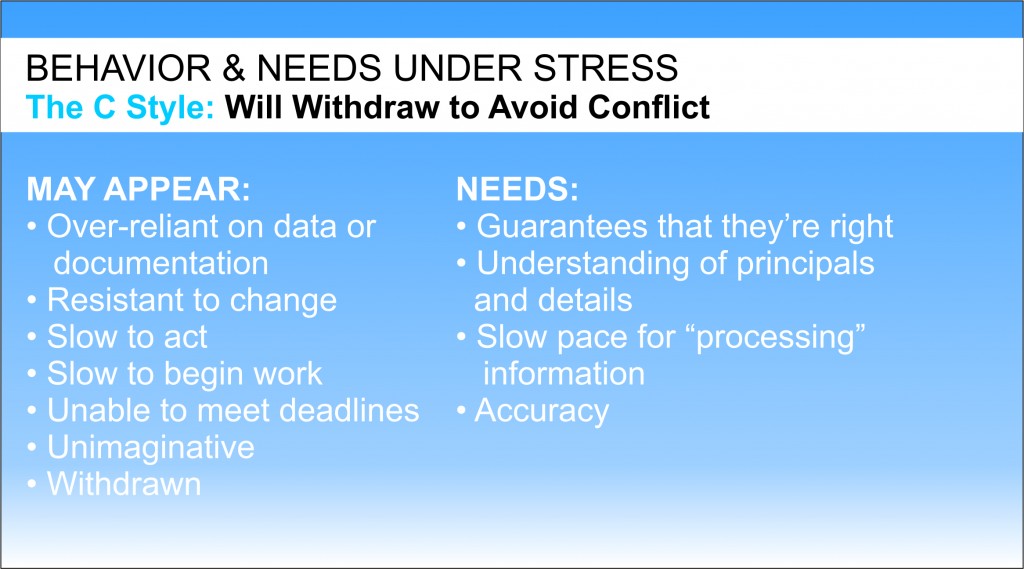

The following charts summarize the behaviors and needs of each style.

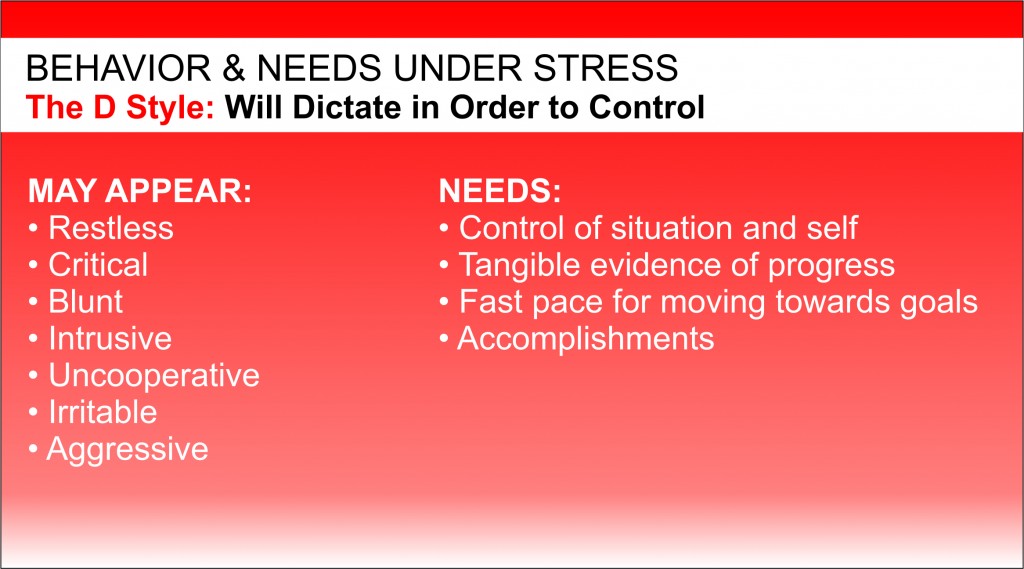

When we identify and control what is likely to stress us we can better react with thoughtfulness. (That is a good time to take a nice, deep breath.) It is OK to understand and accept that we are under stress and not in a comfortable place. That will start to refill our emotional bank account when we need it most. Here are comparisons for each style:

D Style

Emotional/Reactive: “If you can’t stand the heat, get out of the kitchen.”

Thoughtful: “I understand this is stressful. Let’s focus on what we CAN control.”

I Style

Emotional/Reactive: “Hey, let’s move on to something more positive!”

Thoughtful: “It’s difficult not seeing my friends. Can we find a time to get on a Zoom-social call?”

S Style

Emotional/Reactive: “Okay, if that’s the way you must have it, we’ll try it.”

Thoughtful: “I know things are uncertain right now. I just need to know that we are all in this together and we are going to get through it together.”

C Style

Emotional/Reactive: “I can’t help you any further. Do what you want.”

Thoughtful: “I know this is stressful. I just need to unplug for a day.”

When we can get our own emotions controlled by understanding and managing the things that we can affect, then we will be in a better position to help others. By communicating more effectively and reducing our reactive behavior, we will be in a better position to be more accommodating to those around us, on phone calls or in a video chat.

We can then remember to treat others the way they want to be treated. Don’t try to “fix” people. We can remember that they have different needs and fears and we can adapt ourselves to their pace or priority as best we can. It’s a time that we all need to listen more and pay attention to what other behavioral expressions we are broadcasting and being more accepting of the reactions of others.

So, in these troubling times, we do have the ability to make deposits to our own emotional bank account. Even better, when we pay attention and care for others, we can also make emotional deposits to the accounts of those people who are important to us.

Stay safe, stay well.

Tim

Send your questions about how to use your profile to identify and control what is likely to stress you sot that you can better react. Email

Call 772-210-4499 to set up a time to talk about tools and strategies that will lead to better results.

Please share this with a friend/colleague

More Tools:

The first step to building stronger communication is awareness. By identifying how we are similar and different, we can make cognitive choices when interacting to create stronger, more engaged relationships.

Deeper Look at Team Strength DISC Styles

PPP Confusion and Clarifications – Top 40 FAQs

By: Patrick Ungashick

To help our clients and other business owners and leaders respond to the unprecedented leadership disruptions caused by the coronavirus (COVID-19) outbreak, the team at NAVIX offers the following crisis management information series.

Responding to Coronavirus: PPP Confusion and Clarifications – Top 40 FAQs

1.What is the Payroll Protection Program (PPP)?

The PPP is a brand-new loan program created by the CARES Act in response to the COVID-19 crisis.

(Note: Click here to download our 11-point CARES Act Executive Summary.)

2.How much money is available for loans under the PPP? (Or, when does the PPP program run out?)

The CARES Act funded the PPP with $349 billion. The window to apply for the PPP closes either when the $349 billion runs out (on a first-come-first-served basis) or on June 30, 2020—whichever happens first.

(Note: At the time of this writing, some Congressional leaders are advocating additional dollars toward the PPP, but that proposal has not been enacted into law.)

3.What interest rate applies to PPP loans?

The interest rate is 1.0%.

(Note: This figure changed several times as the PPP was being rolled out, but it has settled on 1.0%.)

4.What is the maturity date for PPP loans?

The maturity date is two years, beginning when a PPP loan is made.

(Note: This figure changed several times as the PPP was being rolled out, but it has settled on two years.)

5.Does the business owner need to guarantee the PPP loan personally?

No personal guarantee is required.

6.Does the business owner need to provide collateral for a PPP loan?

No. The Small Business Administration (SBA) has waived the traditional collateral requirement for PPP loans.

7.Does an applicant need to have tried and been unsuccessful in obtaining credit elsewhere?

No. The SBA has waived the traditional requirement that an applicant has been unsuccessful in obtaining credit elsewhere.

8.What businesses are eligible to obtain PPP loans?

Generally, businesses that employ no more than 500 employees. This includes sole proprietorships, self-employed individuals, and most non-profit organizations.

However, some businesses can be eligible even if they have more than 500 employees, as long as they satisfy the existing statutory and regulatory definition of a “small business concern” under section 3 of the Small Business Act, 15 U.S.C. 632. A business can qualify if it meets the SBA employee-based or revenue-based size standard corresponding to its primary industry. Go to www.sba.gov/size for the industry size standards.

Additionally, a business can qualify for the Paycheck Protection Program as a “small business concern” if it met both tests in SBA’s “alternative size standard” as of March 27, 2020: (1) maximum tangible net worth of the business is not more than $15 million; and (2) the average net income after Federal income taxes (excluding any carry-over losses) of the business for the two full fiscal years before the date of the application is not more than $5 million.

If in doubt, contact your SBA-approved lender.

9.Can independent contractors apply for PPP loans?

Yes. While the PPP regulations clearly state that businesses cannot include independent contractors in their payroll calculations, it also states that independent contractors can apply separately for their own PPP loans starting on April 10, 2020.

10.How do you calculate the number of employees to determine the employee-based size limits?

Borrowers may use their average employment per pay period over the 12 months prior to the loan application date, or during calendar year 2019, to determine their number of employees.

(Note: Some lenders seem to be emphasizing using calendar year 2019 data.)

11.Can companies that have private equity or venture capital ownership/investments obtain loans under the PPP?

Potentially. The answer will depend on the type of investment and the degree of control held by the PE or VC organization. Contact your SBA-approved lender.

12.How do the $10 million cap and affiliation rules work for franchises?

If a franchise brand is listed on the SBA Franchise Directory, each of its franchisees that meets the applicable size standard can apply for a PPP loan. (The franchisor does not apply on behalf of its franchisees.) The $10 million cap on PPP loans is a limit per franchisee entity, and each franchisee is limited to one PPP loan. Franchise brands that have been denied listing on the Directory because of affiliation between franchisor and franchisee may request listing to receive PPP loans. SBA will not apply affiliation rules to a franchise brand requesting listing on the Directory to participate in the PPP, but SBA will confirm that the brand is otherwise eligible for listing on the Directory.

13.How do the $10 million cap and affiliation rules work for hotels and restaurants (and any business assigned a North American Industry Classification System (NAICS) code beginning with 72)?

Under the CARES Act, any single business entity that is assigned a NAICS code beginning with 72 (including hotels and restaurants) and that employs not more than 500 employees per physical location is eligible to receive a PPP loan.

In addition, SBA’s affiliation rules (13 CFR 121.103 and 13 CFR 121.301) do not apply to any business entity that is assigned a NAICS code beginning with 72 and that employs not more than a total of 500 employees. As a result, if each hotel or restaurant location owned by a parent business is a separate legal business entity, each hotel or restaurant location that employs not more than 500 employees is permitted to apply for a separate PPP loan provided it uses its unique EIN.

The $10 million maximum loan amount limitation applies to each eligible business entity because individual business entities cannot apply for more than one loan.

14.How much can an eligible borrower apply for under the PPP?

Applicants can generally borrow the lesser of $10 million, or 2.5 times the average monthly “payroll costs,” as explained below.

If there is an outstanding amount of an Economic Injury Disaster Loan (EIDL) made between January 31, 2020, and April 3, 2020, that amount can be added to the PPP loan amount request, less the amount of any loan advance received.

15.What time period should borrowers use to determine their payroll costs to calculate their maximum loan amounts?

Most borrowers will use the calendar year 2019 aggregate payroll data.

(Note: There has been inconsistent information released by the Treasury Department and SBA on this question, with many sources stating that payroll data for the immediate 12-months prior to submitting the loan application may be used instead of calendar year 2019 data. However, the SBA and lenders seem to be emphasizing using calendar year 2019 data.)

16.What if the business has seasonal workers, or is a newly established business?

For seasonal businesses, the applicant may use average monthly payroll for the period between February 15, 2019, or March 1, 2019, and June 30, 2019. An applicant that was not in business from February 15, 2019 to June 30, 2019 may use the average monthly payroll costs for the period January 1, 2020 through February 29, 2020.

17.What are “Payroll Costs?”

“Payroll costs” generally mean the following compensation elements for employees (not any independent contractors) whose principal place of residence is in the US:

- Salary, wage, commission, or similar compensation for any employee whose principal place of residence is in the U.S. (capped at $100,000 on an annualized basis for each employee)

- Cash tips or equivalents

- Payment for vacation, parental, family, medical, or sick leave

- Allowance for dismissal or separation

- Payment required for the provision of group healthcare benefits, including insurance premiums

- Payment of any retirement benefit

- Payment of state and local taxes assessed in connection with the foregoing

18.Are part-time or seasonal employees included in the payroll costs?

Yes. All employees paid during the period of time are included in payroll costs.

19.Are benefits such as healthcare, 401k, and payment of state and local taxes included in the $100,000 per employee cap?

No. The exclusion of compensation in excess of $100,000 annually applies only to cash compensation, not to non-cash benefits, including:

- Employer contributions to defined-benefit or defined-contribution retirement plans

- Payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums

- Payment of state and local taxes assessed on the compensation of employees

20.Are federal taxes included in the payroll costs used to calculate the maximum loan amount?

No. Payroll costs are calculated on a gross basis without regard to federal taxes imposed or withheld, including FICA and Medicare. Payroll costs are not reduced by taxes imposed on an employee and are not increased by the employer’s share of payroll taxes.

21.Do PPP loans cover paid sick leave?

Yes. “Payroll costs” includes costs for employee vacation, parental, family, medical, and sick leave. However, the CARES Act excludes qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act (Public Law 116–127).

22.If the borrower is an S-corporation, are S-corporation distributions included in the payroll costs?

Likely no.

“Specific guidance is not available related to shareholder distributions, but since these distributions are not considered wages to the shareholder, it is presumed that shareholder distributions are not to be included in payroll costs.”

Source: AICPA’s PPP Resources

23.If the borrower is a partnership or LLC, how should partner/member compensation be treated?

For partners in a partnership, the self-employment income of general active partners may be reported as a payroll cost, up to $100,000 annualized, on a PPP loan application filed by or on behalf of the partnership.

24.What if the business uses a Professional Employer Organization (PEO) and therefore, may not be able to document its own payroll information?

There should be proper documents that the borrower can obtain from its payroll provider for the PPP loan application process.

25.What are permissible uses for PPP funds?

Borrowers may use PPP loan funds to pay payroll costs (as previously defined), health care benefits, mortgage interest payments, rent, utility, interest payments on debt incurred prior to February 15, 2020, and/or refinancing an SBA EIDL loan made between January 31, 2020 and April 3, 2020.

26.How much of the PPP loan amount may be forgiven?

The entire PPP loan potentially may be forgiven, plus any accrued interest.

27.Is the loan forgiveness taxable?

No. Forgiveness of any portion of the PPP loan does not constitute taxable income for the borrower.

28.How is the amount of loan forgiveness calculated?

The debt eligible for forgiveness is equal to the eligible expenses paid by the borrowing company during an eight week-period beginning on the date the lender makes the first disbursement of the PPP funds to the borrower. The eligible expenses include:

- Payroll costs (as defined earlier)

- Interest on mortgage obligations incurred before February 15, 2020*

- Rent under a lease existing before February 15, 2020*

- Utilities for which service began prior to February 15, 2020*

- Refinancing an SBA EIDL loan made between January 31, 2020, and April 3, 2020 (less any advance on the EIDL loan up to $10,000)*

*No more than 25% of the forgiven amount may be attributable to non-payroll costs.

Click here to download our guide on How to Maximize the PPP Funds and loan forgiveness.

29.How is loan forgiveness reduced if the borrower lowers salaries or wages, or loses employees, during the eight-week period?

The amount of loan forgiveness is generally reduced by two factors:

- Any reduction in the ratio of (1) the average number of monthly full-time equivalent (FTE) employees during the eight-week period versus (2) those employed during one of two reference periods selected by the borrower: either February 15 to June 30, 2019 OR January 1 to February 29, 2020

- The amount of any reduction in total salary or wages of any employee during an eight-week period in excess of 25% of the total wages and salary of the employee during the most recent full quarter during which the employee was employed—taking into account only employees whose annualized salary was less than $100,000.

(Note: The SBA may provide further guidance to address any changes in non-wage benefits during the eight-week period or any changes outside of the eight-week period.)

30.Can any loan forgiveness be restored if the borrower has already cut employee salaries and/or wages, and/or reduced headcounts?

Yes.

The reduction in loan forgiveness for a reduction in salaries or wages can be avoided if the borrower restores by June 30, 2020 the same wages the employee(s) was earning as of February 15, 2020 as compared to wages paid between February 15, 2020 and April 26, 2020.

The reduction in loan forgiveness for a reduction in headcount can be avoided if the reduction in FTEs that occurred during the period between February 15, 2020 and April 26, 2020 is restored by June 30, 2020.

(Note: We expect further guidance on this issue from the SBA.)

31.What if an employee voluntarily terminates or is terminated for poor job performance? Is the loan forgiveness still reduced in those situations?

Likely yes. At this time, the CARES Act and the PPP guidance issued by the Treasury Department and SBA do not make any distinctions for why an employee may have terminated employment, so that loan forgiveness is only tied to employee count comparisons and whether or not specific employees had their pay substantially reduced. Specific guidance on this question may be forthcoming.

32.When do borrowers need to start repaying a PPP loan?

For any amount of PPP loan that is not forgiven, borrowers may defer making principal or interest payments for six months. But interest does accrue during this deferral period.

33.Are there any prepayment penalties for PPP loans?

No, there are no prepayment penalties on PPP loans.

34.Are there any fees for PPP loans?

No, PPP loans do not require any fees to be paid by the borrower.

35.How many PPP loans can a company obtain?

The program is limited to one loan per borrower, as identified by its Tax Identification Number (TIN) such as the Employer Identification Number (EIN) or the Social Security Number (SSN).

36.How do you get a PPP loan?

Contact a bank or other lending institution that is approved to work with the SBA. Due to the very high demand for PPP loans, it is best to start with your existing banking relationship.

37.When can eligible applicants apply?

Applicants can apply from April 3, 2020, to June 30, 2020.

38.What do applicants need to submit?

Generally, applicants must initially submit a completed SBA Form 2483 (Paycheck Protection Program Application Form) and payroll and other documentation to a PPP lender. The lender may require additional documentation as it deems necessary.

39.Should a business apply for PPP loans through multiple banks?

While there is no restriction against filing multiple PPP applications through different lenders, at the time of this writing, many lenders are only taking applications from existing customers due to high volume. Plus, it is possible that multiple applications from the same applicant could cause confusion, slowing the application, or even triggering potential fraud alerts. Therefore, it seems advisable to work with only one lender, if possible.

40.How long will it take until the borrower gets its funds once a PPP loan has been submitted?

The PPP regulations stipulate that lenders should issue PPP funds within 10 calendar days from the date of loan approval. However, given the massive volume of PPP loans, it is difficult to generalize on loan review and approval times. Contact your SBA-approved lender to inquire about your PPP application status.

Once you have filed your PPP loan application, read this article for 11-steps to maximize the loan forgiveness and impact on your company.

The NAVIX team has helped hundreds of business owners prepare for exit. We have also helped countless owners and leaders deal with recessions, liquidity crises, and economic upheaval. Our experience and perspective enable us to guide our clients through difficult times, such as these.

17 Signs You Might Need a ‘Partnerectomy’

By: Patrick Ungashick

Webster’s Dictionary defines a “partnerectomy” as “the procedure to remove a diseased or failing business co-owner.” Well, OK, that’s not true — it is a word that we made up. But sometimes partnerships need to come to an end. Here are the symptoms to watch for to determine if you have a business partner who needs to go.

Business Partnerships

According to our proprietary research, about seven out of 10 U.S. companies have more than one owner. These partnerships feature two or more leaders coming together with the shared goal of growing the company. Their combined effort and often complementary skills fuel the company’s growth and success. That’s the positive version of the story — and it is often true, especially in the beginning. However, sometimes business partners realize they may not be exactly on the same page on multiple issues. Sometimes it’s possible to reconcile their differences and resume a productive relationship. Other times, the necessary and perhaps the only course of action is to remove the partner in question. In other words, the company needs a partnerectomy.

Some partnerectomies are more difficult than others. Some are painful, angry, risky, expensive, and cause lasting scar tissue. Others are more controlled, safer, less emotional, and leave the organization much stronger than it was before the procedure. Either way, before resorting to this invasive and irrevocable course of action, business co-owners should exhaust every effort and resource to find another resolution to their core differences.

Reasons to Buy Out Your Business Partner

Here are the symptoms that indicate your organization may need a partnerectomy, any of which suggests that it’s time to take action. You may need a partnerectomy if:

1.You and your partner(s) disagree about where to take the company and how to get there.

2.One or more partner(s) want to take all of the company profits home while one or more partner(s) want to reinvest all of the profits back into the company for growth.

3.You believe that there are important topics that you cannot discuss with your partner(s) for fear of damaging the relationship.

4.Deep down, you are not sure that you can trust your business partner(s).

5.Deep down, if you could turn back the clock you would not enter into a partnership with that person(s) again.

6.Deep down, you believe that if that partner(s) were to leave the company, then employees, customers, suppliers, or other third parties would be relieved.

7.You and your partner(s) have very different timelines for when each wants to exit from the company.

8.You and your partner(s) have very different opinions about your company’s value.

9.You and your partner(s) have not signed a buy-sell agreement.

10.Your employees clearly prefer or are aligned with one partner or another, such that divisive factions exist in your organization.

11.Members of your leadership team are unclear what a particular partner actually does inside the company.

12.You believe that if that partner(s) departed from the company tomorrow, the company would not experience any setback or difficulties.

13.You find yourself frequently having to do any of the following for another partner(s): “cover for” him or her, do “damage control,” or “take precautionary steps” to ensure that the other partner does not cause the company problems, intentionally or not.

14.Your partner(s) has ongoing personal habits or issues that create a serious risk for the business.

15.You and your partner(s) do not have current, written, mutually agreed-upon job descriptions.

16.You and your partner(s) are working at different commitment and energy levels but take home the same pay.

17.You and your partner(s) are doing different jobs inside the company but take home the same pay.

It is worth noting that some of these symptoms set off obvious and immediate alarm bells, whereas others seem trivial or harmless. Yet, as the word symptom implies, each of these items may be a surface manifestation of a deeper root issue that, if left unaddressed, can lead to real catastrophe. If you are experiencing any of these symptoms, just like any true medical issue it is advisable to discuss your situation with a knowledgeable advisor, and if necessary, do “more tests.” Contact us to confidentially discuss your situation.

If you have a quick question coming out of this article or, if you want to discuss your situation in more detail, we can set up a confidential and complimentary phone consultation at your convenience contact Tim 772-221-4499

Stumbling Upon Happiness- Book Review

Stumbling Upon Happiness

By: Daniel Gilbert

Book Review by ReadItFor.me

What will truly make you happy? This summary will give you the answers, but be warned, it may no be what you are expecting!

As human beings we spend a lot of time predicting what will make us happy in the future. For some of us it’s the family vacation we’ve always dreamed of, for others it’s the new car we’ve had our eyes on for years, and others it’s finally paying off the mortgage on their home.

Dan Gilbert makes the argument that we are particularly bad at this task, for three main reasons.

First, our imaginations don’t give us and accurate preview of what our emotional futures will be because our brains fill in and leave out important details about the future.

Second, we naturally project our current feelings into a future that will not necessarily exist.

Third, we forget that things will look differently once they happen in the future.

The antidote, Gilbert suggests, is something that most of us will ignore. Join us for the next 12 minutes as we explore why we are not very good at predicting what will make us happy, and uncover the secret to doing it right.

Why we think about the future: Prospection

Here’s a remarkable fact: human beings are the only creatures on earth that think about the future. This is something that Gilbert calls nexting.

The first type of nexting is a survival mechanism and happens immediately and unconsciously. For instance, if you’ve ever been walking on a trail and heard the sound of a rattlesnake, your first instinct will be to move away from the sound as fast as you possibly can. These instincts are built deep into your caveman brain.

The other type of nexting is more about long range planning, like thinking about where you want to retire, or what you’ll eat for lunch next week at that restaurant you’ve always wanted to go to. This type of nexting occurs in our frontal lobes, and allows us to think about the future before it happens. There are a few reasons we do this:

- It’s pleasurable: by thinking about something you’ll enjoy in the future, you get to experience it twice – first in your imagination, and then in real life.

- To protect ourselves: we anticipate negative events so that we can minimize their impact or eliminate them entirely.

- To exercise control: we have a fundamental desire to control our own destiny, and thinking about and planning our future allows us to fill that need.

Which is all fine and dandy, except for the part that we are not very good at it. Which leads us to make choices that work against our ultimate happiness.

Shortcoming #1 – Realism: Filling In and Leaving Out

The first shortcoming of our imagination in predicting what will make us happy is that we fill in the details inaccurately, and leave out details that are relevant to how happy we’ll actually be.

Filling In

There have been plenty of scientific studies that show that our memories are not reliable representations of what actually happened in the past.

Instead of storing perfect records of past events like, say, a video recording, our brains store snippets of past events in different parts of our brain. And then, when we want to recall a memory, our brain finds those fragments and reconstructs them to build the memory.

Whatever isn’t actually there gets filled in by the imagination. And there’s the rub – sometimes the things that our imagination uses to fill in the gaps didn’t actually happen. And then, the brain restores that memory back with the newly fabricated information. Which is why you can get 100 different versions of an event from 100 different people at that event.

This fabrication, Gilbert points out, happens so quickly and effortlessly that we no idea what’s happening – we just believe that whatever we just pulled up in our minds is an accurate representation of the event.

Now, let’s think about our future predictions. How happy will you be next week if your best friend asks you to go to a party with them?

As your imagination gets to work trying to answer this for you, some interesting things happen. If you are like most people, you start to fill in details about the party – where it will be, who will be there, what food and drink there will be, and you’ll use those details to start making predictions about how happy you’ll be.

The problem is that your imagination went through this entire process of filling in details before you even know what they were, and you start to make choices based on your (probably inaccurate) predictions.

The thing to understand here is that your brain does the exact same thing when you are thinking about more important things in your life, like what job you should take and where you should live.

Leaving Out

Just as we fail to consider how much our imagination fills in when we are thinking about the future, we also fail to consider how much it leaves out.

For instance, when most people are asked how they would feel two years after the sudden death of their eldest child, they suggest that they would be totally devastated, wouldn’t be able to get out of bed in the morning, and would perhaps consider committing suicide.

As Gilbert points out, nobody who gets asked this question ever considers the other things that would happen in those following two years – attending another child’s play, making love with their spouse or reading a book while taking in a spectacular sunset.

This is an extreme example, but it illustrates the point that our imagination almost never captures the entire story.

Shortcoming #2 – Presentism: Projecting the Present onto the Future

This shortcoming is a bit easier to explain. Basically, our imaginations are not as imaginative as we believe them to be.

Basically, we tend to fill in holes in the future with data from the present. We anticipate that whatever is going on right now is what will be going on in the future.

For instance, once you’ve stuffed your belly full at a holiday meal, you have a hard time imagining that you’ll ever be hungry again. We fail to see that our future selves will view the world any differently than we view it now.

Or when scientists are asked to make predictions about the future, they almost always err by predicting that the future will be too much like the present. Respected scientists are on record as saying that human beings would never experience space travel, television sets, microwave ovens, heart transplants and nuclear power.

The tendency to project the present into the future ensures that we have a really hard time imaging a future where we will think, want or feel differently than we do now.

One of the more interesting findings from the entire book is that how we think we’ll feel in the future is determined quite heavily by how we feel right now, even if what’s happening right now has nothing to do with what will happen in the future. For instance, when you are having one of those days where everything seems to go wrong, you’ll be much less likely to predict being happy about the get together you have planned with your friends the following week.

Without realizing it, how you are feeling in the moment has a huge bearing on how you’ll be able to predict your future happiness. And, to top it off, you have no idea that it’s happening.

Shortcoming #3 – Rationalization: Things look differently after they happen

Rationalization is defined as “the act of causing something to be or to seem reasonable.”

We all have a psychological immune system that protects us against all sorts of emotional upsets. Like all of the other mechanisms we’ve been describing up until this point, it operates without us realizing it’s there.

The end result is that we, as Gilbert describes, “cook the facts.” Here’s a quick description of a study Gilbert did in order to explain.

A set of experiment subjects were invited to a fake job interview that they thought was real. In the pre-interview, they were (in the middle of a bunch of other questions) asked how they would feel on a scale from 1-10 if they didn’t get the job. When they didn’t get the job (because that was the whole point of the experiment), they didn’t feel quite as bad as they thought they would. In fact, after a short period of time they were just as happy as when the went in to the interview.

Basically, the finding of all of these studies is that our psychological immune system kicks in to protect us from negative experiences, with three caveats.

First, the negative event needs to reach a certain pain threshold. For instance, it will kick in when you are being rejected at a job interview, but not as much if you stub your toe.

Second, it will only kick in once it’s clear that we can’t change the experience. For example, people experience an increase in happiness when genetic tests show that they don’t have a dangerous genetic defect (as expected) or when the tests reveal that they do have one, but not if the results are inconclusive.

Third, we have a much easier time rationalizing actions that we have taken rather than inaction.

The end result is that we fail to realize our ability to generate a positive view of our current circumstances, and thus forget that we’ll do the same in the future. Ultimately leading us to not accurately predict how happy we’ll be in the future.

The Solution: Asking Others Experiencing It Right Now

As Gilbert points out, most of what we know is not based on our own direct experience, but on second hand knowledge. You’ll find this to be true if you make a list of all the things you know and go line by line marking it firsthand or secondhand.

We believe and put our faith in many things that we have learned secondhand, but when it comes to deciding what will make us happy, we stubbornly rely on our “nexting” mechanism in almost every case. As we’ve already learned, that strategy doesn’t lead to good outcomes. We forget how good or bad things were in the past because of our selective and unstable memories, and then we project those memories into the future to make inaccurate predictions on how we’ll feel then.

This is the point in the summary where we discuss the advice that Gilbert suggests we’ll most likely not take.

By far the most accurate way to determine whether or not a certain future state will make you happy is to ask somebody who is experiencing it right now.

Do you want to know what it will be like to move to a foreign country and leave your family and friends behind? Ask somebody who just did it. Want to find out how you’ll feel about it 10 years from now? Ask somebody who moved 10 years ago.

As Gilbert says, the human race is like a living library of information about what it feels like to do just about anything that can be done. All you need to do is ask.

There are studies that show that when people are forced to use surrogates to determine how happy they will be about a specific imagined future, they make very accurate predictions about their future feelings.

So why do we reject the solution? Because we don’t like to think of ourselves like the average person. Maybe other people are bad at predicting their future happiness, but not me. As you might have guessed, that’s what EVERYBODY says. So while you are busy rejecting the solution because you are unique, you are merely confirming that you are exactly like everybody else.

The biggest mistake we make, Gilbert suggests, is that we don’t make very good predictions about how happy accumulating more “stuff” will make us.

There is a mountain of evidence that beyond a certain level of wealth, it makes little to no difference in the level of happiness you experience. Yet we keep striving for more.

The problem is that the entire market economy system depends on people continually buying and producing more and more stuff. As Gilbert points out, if everyone was content with the amount of stuff they had, the economy would grind to a halt.

So, the next time you find yourself about the pull the trigger on that big splurge purchase, consider finding somebody who did the same and ask them how much happiness it added to their life beyond the initial jolt of excitement.

You might be surprised at the results.

Call 772-210-4499 or email to set up a time to talk about tools and strategies to lead to better results.

Please share this with a friend/colleague

13 Things That Will Kill Your Exit Happiness

We believe business owners deserve to exit happily. After all, what is the purpose of working as hard as you do if you never manage to reach your business and personal goals at exit?

Exit impacts nearly every area of a business owner’s life. Failing to exit happily one day could ruin a lifetime of dedicated work and sacrifice. Therefore, it helps to know the most common reasons why owners fall short of exit happiness.

Let’s call these the Happiness Killers, and these are the 13 Happiness Killers you should know about.

1. Failing to reach financial freedom. It’s not enough to exit the company and sell for a good price or maximize value. The more important question is, are you financially free after exit? If you exit but come up short of financial freedom, you may find yourself regretting having exited at all.

2. Getting too little cash at closing. It’s natural to fixate on the total price you expect to receive when selling the company. However, just as important as total price is how much cash you get at closing. Any dollars that you do not receive at closing are dollars you might never see. If you never receive those dollars, you could end up exiting unhappily.

3. Working with (or for) people you don’t like or respect. Many owners keep working after exit with (or for) the company’s new owners/leaders. If you later learn that you do not like or respect these people, you may find yourself deeply unhappy. This is especially true if you did not reach financial freedom (see #1) and therefore cannot afford to just walk away from the situation.

4. Doing something that you don’t love. It does not matter how much money you have in the bank if you wake up every day facing doing something that you do not enjoy. As with the previous Happiness Killer, this can undermine your personal happiness regardless of how financially successful your exit may be.

5. Not knowing what you are going to do in life after exit. After exit, most owners search for something to do that provides the stimulating challenges and sense of identity that they enjoyed from running their companies. If you never find this, you may struggle to be happy after exit.

6. Feeling like your top people were mistreated. Your business’s value is undoubtedly rooted in its people. You likely will not be happy if your exit causes your people to unfairly lose their jobs or if it strands former employees in an inferior work environment.

7. Feeling like your customers are getting less value. An exit that significantly diminishes the quality of goods or services you had been providing customers is not a happy exit.

8. The exit breaks up relations between business partners. If you have business partners, you will probably care deeply about how they fare during your exit – and theirs. There are many ways that one partner’s exit can undermine another partner’s goals or plans. Partners who lack alignment regarding these issues often end up exiting unhappily.

9. Leaving before you wish to. Leaving your company before you want or intend is a Happiness Killer. You will likely feel as though somebody ripped your company away from you.

10. Sticking around longer than you want to. The opposite side of this issue is having to stay with the company any longer than you prefer after your exit. If you have other things you’d rather do and pursue, then being forced to stick around with the company will not be a happy exit.

11. Exit causing stress at home/in marriage. Exit brings massive change in an owner’s personal life and relationships, especially with your spouse or significant other. Many couples are caught off guard and find themselves disoriented in the post-exit world. Left unchecked, this can lead to regret and unhappiness.

12. Not leaving the company in good hands. If you exit the business only to realize later that the company’s new leaders are not competent to run the company and/or not equally committed to its success as you were, you may find yourself unhappy long after your exit.

13. Paying more taxes than you could have. Your exit will probably be the most expensive transaction in your life, with taxes comprising the largest line item costs in most situations. An excessive tax bill can undermine not only your nest egg but also your sense of fairness and satisfaction.

With so many exit Happiness Killers out there, it’s prudent and wise to evaluate which of these potential threats you have adequately addressed and which may still be in your future. Ask us how to do this. You are working too hard and have made too many sacrifices not to be sure that you are on the path to future exit happiness.

Download the eBook now.

Schedule a 45-minute consultation to see how you can achieve a financially rewarding exit.

Contact Tim for a complimentary consultation: 772-221-4499 or email.

What’s More Important When Selling Your Company: Price or Terms?

Imagine a potential buyer — let’s call them Buyer A — has just offered $20 million all-cash to acquire your company. Another potential buyer — let’s call them Buyer B — also offers $20 million, but their offer is paid out in equal installments over a period of 10 years.

If nothing else differed between the two offers, which would you choose? Most would take the $20 million paid up front from Buyer A, rather than wait to get paid by Buyer B and take the risk that some of those future payments might never occur.

That much is pretty clear. But what if Buyer B increased their offer to $25 million, still payable over 10 years? Would the $5 million increase in total price outweigh the need and risk to wait to be fully paid? If you would still choose Buyer A’s $20 million all-cash offer, then what if Buyer B upped the offer to $30 million? Then which would you choose?

Different Buyers Will Offer Different Prices and Terms

This hypothetical exercise may seem over simplistic, but it’s quite relevant in the real world. When selling your company at exit, different buyers will not only offer different prices, but they will also offer different terms.

There are a wide variety of potential differences in terms. In the example above, Buyer B offered a different payment schedule — time was the difference between the two offers.

But buyers can use a complex array of different terms. They can vary the currency they use in their offer: cash, stock, notes, etc.

Buyers can also vary the deal requirements, such as whether or not they require you to stay involved with the company for some period of time post-sale and/or if you must sign a non-compete agreement.

Put all these pieces together and the picture can get complicated very quickly. Comparing different prices from different buyers is easy; comparing different sets of terms can be arbitrary and difficult.

If you eventually sell your business at exit, don’t be surprised if you find yourself more concerned about the deal’s terms than about the total purchase price. In other words, the highest-priced offer to buy your company might not be the winning bid. Many owners who have the opportunity to choose from multiple offers select the buyer with the most attractive terms, rather than the buyer paying the highest total price.

Strengthen Your Company Before You’re Ready to Sell

This issue is important now, even if you are not planning on selling your company for a while. Buyers often use deal terms to address a perceived weakness in the target company. Knowing the reasons for these deal terms gives you the information you need to rectify any potential such perceived weaknesses and set yourself up for favorable terms when you do finally sell.

Here are a few common examples:

- A buyer might hold back cash and require an earnout in the offer price when the buyer is not convinced that the company future growth’s will be as robust as the seller forecasts. The buyer’s doubts might be created by inconsistent or subpar growth rates or by a business plan that is unclear or unconvincing.

- A buyer might insist as part of its terms that you must remain with the company for a designated period of time post-sale if that buyer has concerns about the company’s leadership team performing well without you. (Ask us how to overcome this.)

- A buyer might hold back cash in an escrow account if your company has a small number of large customers, any one of which could leave as a result of the company sale.

To minimize the risk that you will be forced to accept burdensome terms when you sell your company, it is important to work on strengthening the company’s value well before you are ready to sell.

It can take several years to address the issues within a company that lead to less than favorable deal terms at sale. Getting started now puts you in the driver’s seat, driving toward the best of both worlds — the highest price AND the most attractive terms.

Your last five years

One of the most common, and important, questions business owners ask is “When should I start my exit planning?”

Your Last Five Years eBook

How the Final 60 Months Will Make or Break Your Exit Success

To learn more about the steps necessary for a successful exit, contact Tim for a complimentary consultation: 772-221-4499 or email.

The Biggest Mistake Business Owners Are Making Right Now

By Patrick Ungashick, CEO

I speak to more than 50 business audiences per year about getting ready for exit, putting me in front of thousands of business owners. Perhaps the biggest mistake that I hear owners making right now with regard to their exit planning is not having an answer to this one question:

“What are you waiting for?”

Let me explain, because there are two potential ways to interpret this question.

Consider the Financial Implications of Not Selling Now

First, I commonly hear owners say they intend to exit and sell the company sometime in the next several years, with a typical answer of “within three to five years.” When I hear this statement, my next response is, “What are you waiting for?”

What I mean is why is that owner waiting a few more years? Why not just sell now? At the time of writing this article (October 2018), multiples for small to mid-market companies are near all-time highs in most industries, and buyers are flush with cash.

If you seriously intend to sell sometime over the next three to five years (which is only 36 to 60 months), then why not go ahead and try to sell the company now? A reasonable person can conclude that multiples are likely to be lower in the near future.

Consider the financial implications if you don’t sell now. If multiples in your industry fall by 25% over the next few years — a common decline when coming down off the highs we are currently experiencing — then your company has to grow its profits by 25% just to tread water on its value. Why take that risk?

There are sound and compelling reasons to wait to exit despite today’s strong prices. I am not suggesting that a business owner should rush and exit before he or she wants to or is prepared. But that’s not what I hear when I ask this question.

Overwhelmingly, owners don’t have a concrete answer when I ask what they are waiting for. Typically, they offer up vague answers about being busy or pursuing more growth without a clear finish line. That’s a mistake. If you are going to sit out the current strong market, do so for clear and compelling reasons. If you lack clear and compelling reasons, then go back to the question:

“What are you waiting for?”

(Before proceeding, a quick editorial comment. As exit planners with a business predicated on five-year exit strategies, suggesting you should consider exiting now potentially eliminates you as a prospect for our services. I point this out to illustrate why I ask this question regretfully.)

Not Preparing for Exit Creates Unnecessary Risk

There is a second interpretation of my question. Many owners recognize that they are not ready to exit right now. Common reasons owners and companies are unready include:

- The company is too reliant upon the owner’s involvement

- The customer base is heavily concentrated around a few large accounts

- The leadership team has holes in it or needs upgrading

- The financial statements and report are not sufficiently reliable and robust

- The partners (if applicable) are not in alignment

- The owner has not yet figured out his or her plans for life after exit

Whatever the reasons, the mistake is not being unready for exit. Rather, the mistake is waiting to make the commitment and waiting to create a plan to address these issues by a specific deadline.

Companies do not get ready for exit without significant effort – getting ready for exit takes years of work and preparation. (Ask any owner who has exited and you will almost universally hear, “Yes, I wish I had started earlier and given myself more time to prepare for exit.”)

To be fair, owners do not have to engage outside help like us — they can do it themselves. But whether working with advisors or doing it on your own, what are you waiting for to prepare yourself and the company for exit?

When I ask this version of the question, owners offer up the same vague answers as before about being busy or pursuing more growth without a clear finish line. At some point, owners have to realize that they will always be busy, and the company will always have more potential ways to grow.

Unfortunately, this realization often comes too late. Waiting to commit to getting the company ready creates unnecessary risk, and it is perhaps the primary reason why so many owners struggle to exit smoothly and happily.

So… What are you waiting for?

To learn more about the steps necessary for a successful exit, contact Tim for a complimentary consultation: 772-221-4499 or email.

Exit Planning Consultation

Are you thinking more and more about your future exit and realizing you have more questions than answers? Do you know what you want out of your exit but are unsure of the best plan to achieve your goals? Are you wrestling with your ideal time to exit? Unsure how to talk to your employees? Worried about your business partners? And what can be done to minimize taxes?

These are just some of the questions we commonly hear during the confidential, complimentary 45-minute consultations we hold with business owners to help them get ready for exit. For the fifth year in a row, this month we are standing by, ready to schedule a free consultation with you to answer your exit questions.

Feel free to watch this short video to learn more. Or, schedule your consultation here or by calling 772-210-4499 .

Seven Signs You and Your Business Partner Are Not on the Same Page

Register Now

If you have one or more business partners, you know it’s critical to be in alignment on your plan for the company, and your goals for exit. But many business partners are not on the same page, especially around what they want to happen at exit.

This webinar explores:

- The seven signs that might indicate you and your partner(s) are not on the same page

- How lack of partner alignment hinders or derails exit success

- Steps to take to get partners on the same page for exit

Check out our archive of all past NAVIX exit planning webinars:

Click here to view now

To discuss your unique business, and how to plan for and achieve a successful exit, Call 772-210-4499 or email Tim to schedule a confidential, complimentary consultation.

How do you get your point across in a world full of distractions?

Periodically, I share a favorite book review from Readitfor.me.

There is never enough time to read all the latest books – this tool is a great way to learn and to stay on top of the latest topics and new ideas.

The Readitfor.me tool has grown into a great resource for both personal and team growth, offering book summaries, micro courses and master classes. Check out this link: Readitfor.me. See how these tools can help build you personal and Team Strength.

Here is a summary of the Book Brief by Joseph McCormack.

Getting you point across clearly and concisely, saves resources- time and money.

Read on to learn how you can get your point across in a world full of distractions.

Brief

by Joseph McCormack

Book Review by ReadItFor.me

We live in an attention-deficit economy, and being brief is both desperately needed and rarely delivered.

When we are not clear and concise, there are consequences. Time, money and resources are wasted. Decisions are made in confusion, great ideas don’t get pursued, and deals take far too long to close.

This book is all about getting your story straight, and then getting to the point. Quickly.

Join us for the next 12 minutes as we explore how to communicate your message briefly, and powerfully. As author Joseph McCormack points out – it’s like Six Sigma for your mouth.

Let’s get started.

Why Brevity Is Vital

These days, everybody is busy. Especially executives. Your rambling marketing message or sales pitch is likely to get lost in the daily flood of information they struggle to stay on top of.

As McCormack points out, being brief is not just about time. The more important point is how it feels to the audience. It’s not about using the least amount of time. It’s about making the most of the time you have.

There are three things you need in order to adhere to the principles of brevity – be concise, clear, and compelling. What follows naturally from this is that you also need to have a through understanding of your subject matter.

Mindful of Mind-filled-ness

Living in a world full of distractions means that the people around you are mentally stretched. That makes getting to your point before your audience gets distracted an imperative.

There are 4 main sources of pressure your audience is battling as you try and get your point across:

- Information overload, which has gotten worse as social media and email invades our lives more and more every day;

- Inattention, causing them to struggle with paying attention longer than 10 seconds at a time;

- Interruptions, which means that there are many different things competing for attention at all times;

- Impatience for creating results, which causes people to be stressed almost all the time.

Here’s the point. Even if you are given 30 minutes to make a presentation, you have far less than that before your audience tunes you out.

Why You Struggle with Brevity: The Seven Capital Sins

In spite of the evidence that brevity is a necessity in today’s world, it turns out to be difficult to master because of what McCormack calls the “seven capital sins.”

- Cowardice. You don’t have the guts to be clear and take a stand on the issue, so you mask your message in mounds of jargon and buzzwords.

- Confidence. You know the material so well and can’t help explaining it in painful detail.

- Callousness. You don’t respect people’s time. When you say “this will only take a minute”, it ends up taking many times that.

- Comfort. When you are comfortable with an audience, you let yourself get wordy and drag the story out.

- Confusion. You tend to do your thinking out loud, not mindful that your audience would rather hear the finished product.

- Complication. You think that the issue is really complicated, missing the point that your job is to simplify it for people.

- Carelessness. You don’t think about what you are going to say deeply enough, and so your message gets mixed up.

Brevity Tool #1: BRIEF Maps

People who start to gain experience in making presentations and sales pitches mistakenly abandon outlines, thinking they are a tool that only rookies use.

Professionals understand that an outline is critical to their success. McCormack tells us that there are five immediate benefits you’ll get by using them.

Outlines keep you:

- Prepared, so you are ready to deliver your message.

- Organized, so you understand how all of your ideas connect.

- Clear, so you are certain what your point is.

- Contextual, so you can draw a bigger picture so your point stands out.

- Confident, so that you know what to say, inside and out.

The BRIEF way to do an outline is organized as follows:

- B: Background or beginning;

- R: Reason or relevance;

- I: Information for inclusion;

- E: Ending or conclusion;

- F: Follow-up or questions you expect to be asked or that you might ask;

This format can be used for anything you need to present – from an important project update to your team to the most important sales pitch of your life.

Now that we’ve covered how to outline your message, let’s move on to how to deliver it.

Brevity Tool #2: The Role of Narratives

Bore your audience to death with corporate-speak and they’ll tune you out faster than you can say “next slide.” But tell them a good story and they’ll gladly give you their undivided attention.

McCormack introduces us to the idea of the Narrative Map to help us do just that. There are five elements in the map.

The focal point

This is the central part of the story, and tells the audience what it’s about. For instance, at the beginning of his presentation launching the iPhone, Steve Jobs said “Today, Apple is going to reinvent the phone.”

Setup or challenge

In the context of a marketing or sales message, this is the challenge, conflict, or issue in the marketplace that your organization is addressing. Every great story includes a dragon that needs to be slayed.

Opportunity

This is about communicating the opportunity that the challenge poses. Some people call this an unmet need or an aha moment.

Approach

Now we move on to how the story unfolds. This is the how, where and when of your story, describing how you’ll solve the problem or take advantage of the opportunity. There are usually three or four key points to be made here.

Payoff

All good stories include a payoff at the end. This is where you paint the picture of what life looks like for your audience after your solution is implemented.

So that’s how you outline and then craft a narrative that gets communicated clearly, concisely and powerfully.

Let’s now move our attention to a method for being clear in our every day conversations with the people around us.

Brevity Tool #3: Controlled Conversations and TALC Tracks

As McCormack points out, if we are undisciplined in how we present information, we are even more undisciplined in how we have our daily conversations.

Being brief in a conversational setting means shifting from endless monologues to what he calls having controlled conversations. These conversations have a rhythm, a purpose, and a point.

In order to get conversations right, there are things you need to do, and things you need to avoid.

Let’s start with the three common mistakes that draw people into long, unwieldy conversations:

- Passive listening: Letting the other person babble on about everything and say nothing. As a result, there is no control.

- Waiting your turn: Letting the person talk, then jumping in to say your part. As a result, two separate conversations are happening.

- Impulsively reacting: Responding to a word or thought the other person said. As a result, there is no clear direction in the conversation.

Now let’s move to a structure for balance and brevity. McCormack calls these TALC Tracks.

T is for Talk

Somebody in the conversation starts talking. It could be you or the other person. There are two things to consider at this stage:

- Be prepared to say something when the other person finishes speaking.

- Make sure your response has a clear point.

AL is for Actively Listen

Listen closely to what the other person is saying the entire time. Don’t zone out, multitask, or otherwise take your attention off the other person. There are two things to consider at this stage:

- Ask open-ended questions related to what you heard.

- Dig deeper into the parts of the topic you are genuinely interested in.

C is for Converse

When a natural pause happens in the conversation, it’s your turn to jump in with a comment, question, or sometimes a bridge to another topic. There are three things for you to consider at this stage:

- Don’t use your turn to start a new conversation.

- Keep your responses short.

- Know when to stop so the other person can start talking again.

When and Where to be Brief

Now that we’ve covered the foundations of how to be brief, let’s go into some specific examples of when and where to be brief.

In Meetings

We all know that meetings suck. There are three villains that you need to slay in order to make them suck less.

- Reduce the amount of time devoted to them. Put the BRIEF back in briefings.

- Consider a standing meeting, or a meeting with no table. And most importantly, meetings should be more like a conversation than a presentation.

- Making sure that no one person dominates your meetings. That includes outside presenters.

Social Media

McCormack suggests that we create social media posts and emails that respect a busy executive’s time. That almost always means making things shorter.

Presentations

The best way to deliver a presentation is to first understand what your audience wants to hear, and then speak to those things, and those things only.

Job Interviews

Nobody likes job interviews, and that includes the person doing the hiring. When you are the candidate, create a BRIEF Map that quickly explains why you are qualified. Then, tell a story that shares some of your past successes that demonstrate what your potential employer is looking for.

Sharing Good and Bad News

When you are sharing good or bad news with your team, always get to the point quickly. Then, let some time for the news to sink in and leave time for them to ask questions.

When you are delivering bad news in particular, consider three important issues:

- State bad news simply and clearly, without pulling punches.

- State the real reasons for the bad news so people know what’s happening.

- Take advantage of tough situations to have a heart-to-heart.

Conclusion

Everybody is busy. The world is begging you to get to the point quickly.

As Franklin D. Roosevelt once famously said:

Be sincere, Be brief, Be seated.

and see how this tool can you build your company for long term success.

Please share this with a friend/colleague

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.

Tim is a Consultant to Business, Government and Not-for-Profits Organizations specializing in innovative and challenging ways for organizations to survive, to thrive and to build their teams.